I was at CES 2024, when somewhere between two meetings I ran into Jason Chinnock, CEO of Ducati North America.

We’d never met. I gave him the two‑minute version of what we do at Prelaunch: real product validation based on behavior, not just what people say on a survey.

Jason listened. Really listened. Barely interrupted. When I finished, he just said: “I think I have an idea where this could be useful.” Then he headed to his next meeting.

No follow‑up. No NDA. No long sales cycle.

A year later, my inbox lit up. Ducati wanted to explore something big.

They were preparing to enter off‑road, for the first time in brand history, with what would become the Desmo450 MX. And they didn’t want just feedback. They wanted practical, defensible insight they could take into product, pricing, and launch planning.

They needed to be confident about the data to make smart decisions.

That quiet moment at CES turned into one of my favorite collaborations.

Why This Was Interesting

Ducati is shorthand for speed, precision, and Italian engineering beauty. Asphalt. Racing. Road performance.

Off‑road?

It’s a whole different culture. Different riders. Different expectations. Different purchase criteria. Even different media channels.

So Ducati’s real question wasn’t just “Can we build a dirt bike?” They already knew how to engineer great motorcycles.

The question was: Who is the off‑road Ducati rider, and what would make them put money down before a single bike ships?

What Ducati Needed with Prelaunch

They asked us to help them with a couple of things:

- Confirm there’s a real segment for a Ducati off‑road bike.

- Figure out who those buyers actually are (not who we think they are).

- Learn how riders evaluate off‑road bikes—what matters, what doesn’t.

- Surface objections and hesitation points early.

- Gather actionable inputs to guide product decisions, pricing, messaging, and launch.

In short: Proof. Not hope.

How Prelaunch Works (and Why Ducati Chose It)

Traditional research asks: “Would you buy this?” And people say nice things, click a few buttons, collect reward points, and move on.

We flip that.

Step 1: Ask for a small, fully refundable deposit.

If you’re actually interested, you’ll put down money even if it’s refundable. That moment changes everything. It moves people from opinion mode to decision mode.

Step 2: Talk to the people who put money down.

These are not random panel respondents. They’re self‑selecting, motivated, and emotionally engaged.

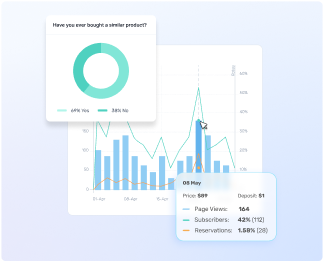

Step 3: Layer behavioral signals + qualitative interviews + AI synthesis.

That’s where the real picture of demand forms.

This approach has been used by teams at P&G, Bosch, 3M, Philips and others—but Ducati pushed us into new territory: a premium performance brand moving into a totally new category.

The Ducati x Prelaunch Campaign: What We Actually Did

1. Real‑World Buying Simulation

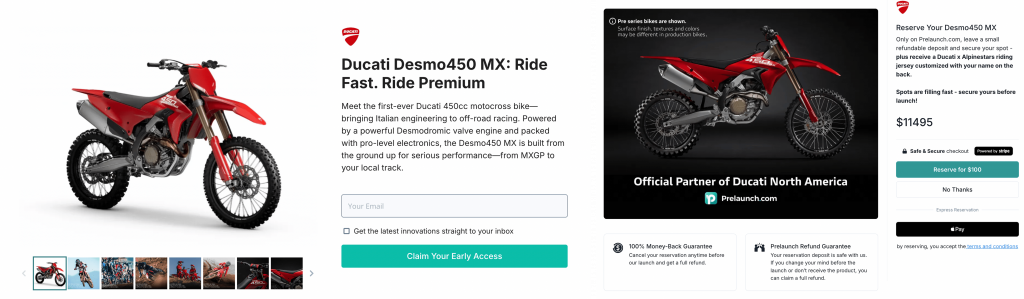

We worked with Ducati to launch a focused landing experience for the Desmo450 MX concept. Visitors could reserve with a $100 fully refundable deposit and unlock early access perks.

That $100 wasn’t about funding production. It was a behavioral filter a way to separate curiosity from intent.

2. Automatic Behavioral Segmentation

Once live, traffic sorted itself:

Buyers (Early Adopters): Put money down. Emotionally invested. Willing to talk.

Interested Non‑Buyers: Looked, clicked, read specs… but didn’t reserve. Still valuable. Their “no” teaches us just as much as the “yes.”

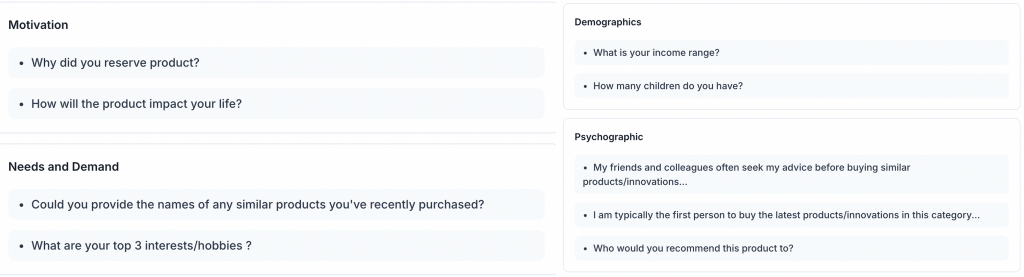

3. Qualitative Deep Dive

We triggered the survey immediately, timing matters because emotions fade fast.

Post‑deposit survey: ~70% completion across a detailed 20‑question flow (huge by industry standards).

Video interviews: Dozens of depositors joined calls and spoke like co‑creators, not respondents.

Non‑buyer interviews: Helped map hesitation: price, category fit, service questions, experience concerns.

4. AI‑Powered Personas (Living, Not Static)

We fed behavioral data, survey responses, and interview transcripts into Prelaunch’s AI engine. Out came dynamic personas that:

- Used real rider language (not marketing copy dreamed up in a boardroom).

- Surfaced emotional triggers: prestige, curiosity, “first to own,” brand pride.

- Ranked decision criteria: performance, suspension, reliability, service network, weight.

Could be queried in real time: Ducati’s team could ask, “How would riders react if we added launch control at +$X?” and get persona‑driven directional feedback.

What Surprised Us (and Ducati)

1. Demand Held at Full Price

No discount ladders. No “early supporter” price games. The reservation reflected the full planned MSRP: $11,495.

People still placed deposits. That’s pricing validation rooted in behavior, not survey intent.

2. The Core Audience Wasn’t Who We Expected

Going in, the mental picture was a younger, high‑energy, cross‑category rider.

The data said otherwise:

- The majority were men 55–64.

- Mostly U.S.-based.

- Experienced riders with disposable income.

Many already owned multiple bikes and had long histories with premium brands.

That discovery changed Ducati’s thinking: channel mix, event targeting, dealer conversations, even creative tone.

3. Why Riders Reserved

Here’s what we heard often in their own words:

Emotional: “I want to be part of Ducati’s first dirt move.” Prestige + novelty.

Functional: Expectations around engineering, suspension, weight, and the Desmo heritage. If Ducati does dirt, it better perform.

Brand: A solid chunk basically said: “Because it’s Ducati.” That logo carried trust into unknown terrain.

4. Factory Edition Momentum

Enough riders pushed for higher‑spec components launch control, racing suspension, and traction systems that Ducati had confidence to explore a Factory Edition path for the most performance‑hungry segment.

That came directly from rider signals, not internal guessing.

What This Meant Inside Ducati

Here’s what the team could do with confidence:

- Stand firm on price. Buyers were willing to engage at full value.

- Retarget messaging. Focus less on “new category for young dirt converts,” more on experienced multi‑bike owners looking for something special.

- Plan variants. Use behavioral demand to justify premium trims.

- Align launch sequencing. Move faster in the U.S., where engagement was strongest.

When you have real deposit‑backed behavior, internal debates get shorter. Decisions move.

What I Took Away Personally

That CES hallway conversation reminded me of something important: the best partnerships don’t always start with a hard sell. They start with curiosity.

Jason didn’t pressure. He didn’t over‑promise. He just filed it away until the right strategic moment.

When that moment came Ducati moving off‑road he already knew where to go for evidence over opinion.

And that’s what still excites me about this work: helping teams do bold things with their future customers, not in isolation from them.

Key Wins after the Validation and how Prelaunch helped

✅ Validated real demand at full MSRP ($11,495).

✅ Identified a lucrative, older, high‑experience rider segment.

✅ Mapped emotional + functional motivation drivers.

✅ Surfaced blockers from non‑buyers early (price, fit, support).

✅ Supported development of a potential Factory Edition.

✅ Gave internal teams data to move faster and with less risk.

Final Thought: Innovation Needs Skin in the Game

In fast product cycles, it’s easy to confuse input with evidence. Slide decks are input. Opinions are input. Even survey intent is input.

Evidence is when someone reaches for their wallet even if the money is refundable because they don’t want to miss out.

That’s what happened here. Ducati didn’t just test a webpage. They tested the willingness of real riders to be first.

And before a single tire hit dirt, Ducati already had traction.

Thinking about launching in a new category?

Happy to share what worked (and what didn’t) from the Ducati Desmo450 MX project.

Just let us know.