In the ever-evolving landscape of startups, grasping your market isn’t merely advantageous—it’s a necessity. Whether you’re a budding entrepreneur, a small business owner with growth ambitions, or a business student hungry for knowledge, thorough market research is your compass to navigate the path to success.

This blog post will guide you through the importance of market research for startups, the different methods you can use, and practical steps to execute it efficiently. We’ll also share some real-world examples to illustrate these concepts. By the end, you’ll have a solid understanding of how to gather market insights and validate your business ideas effectively.

What Is Market Research for Startups and Why Is It Important?

Market research is the systematic process of collecting, analyzing, and interpreting data about your target market, competitors, and industry trends. It allows you to answer critical questions like:

- Is there a real need for your product or service?

- Who is your ideal customer, and what are their pain points?

- How big is the market opportunity?

- Who are your competitors, and what are their strengths and weaknesses?

- How will you price your product or service competitively?

By investing time and resources in market research, you gain valuable insights that minimize risk and increase your chances of success. Here’s why market research is crucial for startups:

Idea Validation: It helps you determine if there’s a viable market for your concept and identify potential problems before substantial investment.

Customer Focus: It allows you to tailor your product or service to your target audience’s specific needs and preferences.

Competitive Advantage: By understanding your competitors, you can differentiate your business and develop a winning strategy.

Informed Decisions: Data from market research empowers you to make well-informed decisions about product development, marketing, and pricing.

Types of Market Research for Startups

Market research for startups is like having a toolbox filled with different instruments – each with its own strengths and purposes. Understanding these research types empowers you to choose the right tool for the job and gather the most valuable insights for your venture. Let’s delve deeper into the two main categories:

Secondary Research: Leverage Existing Data

Imagine a treasure trove of pre-existing information waiting to be explored. That’s the beauty of secondary research. It involves utilizing data collected by other organizations, saving you time and resources. Here are some key sources to tap into:

Industry Reports: Market research firms and industry associations publish reports on market size, trends, demographics, and competitor analysis. These reports offer valuable insights into the overall landscape you’re entering. (Example: Gartner)

Government Publications: Government websites often provide a wealth of data, including economic indicators, consumer spending patterns, and demographic statistics. This data can help you understand your target market’s characteristics and purchasing power. (Example: US Census)

Market Research Databases: Subscription-based databases like Statista and IBISWorld offer a vast collection of market research reports across various industries. They can be a goldmine for in-depth data and analysis on specific market segments. (Examples: Statista & Euro Monitor)

News Articles and Publications: Industry publications and news websites often publish articles on market trends, product launches, and consumer behavior. Staying updated on these resources allows you to keep your finger on the pulse of the market.

Advantages of Secondary Research

- Cost-effective: It’s a budget-friendly way to gather a significant amount of data.

- Quick and Easy Access: Existing data is readily available, saving you time on data collection.

- Broad Overview: Provides a comprehensive picture of the market landscape and trends.

Limitations of Secondary Research

- May Not Be Specific Enough: The data might not be tailored to your specific niche or target audience.

- Outdated Information: Ensure the data is recent to avoid basing your decisions on outdated trends.

- Limited Control over Quality: You rely on the methodology and accuracy of the data collected by others.

Primary Research: Gather First-Hand Insights

Primary research allows you to delve deeper and gather data directly from your target audience. This provides a clearer understanding of their specific needs, preferences, and opinions. Here are some common methods used in primary research:

Surveys: Online surveys are a versatile tool for collecting quantitative data from a large sample size. You can use surveys to gather information on demographics, product preferences, pricing perceptions, and customer satisfaction. Tools like SurveyMonkey and Google Forms make creating and distributing surveys a breeze.

Interviews: In-depth interviews with potential customers provide rich qualitative data. By engaging in one-on-one conversations, you can uncover deeper motivations, buying behaviors, and pain points that might not be readily apparent in surveys.

Focus Groups: Bringing together a small group of target customers for a moderated discussion allows you to explore specific topics in detail. Focus groups can generate valuable insights into customer perceptions of your product concept, existing solutions in the market, and potential areas for differentiation.

Usability Testing: If you have a prototype or beta version of your product, conducting usability testing allows you to observe how potential customers interact with it. This helps you identify any design flaws or areas for improvement before launch.

Social Media Listening: Monitoring online conversations about your industry or competitors on social media platforms can reveal valuable insights into customer sentiment, emerging trends, and potential brand perception issues. Tools like Brandwatch and Sprout Social can help you track relevant conversations.

Advantages of Primary Research:

- Targeted Insights: Tailored specifically to your niche and target audience.

- In-Depth Understanding: Provides deeper insights into customer motivations and behavior.

- Actionable Data: Helps you make informed decisions about product development, marketing strategies, and pricing.

Limitations of Primary Research:

- Costly: Conducting surveys, interviews, and focus groups can be expensive, especially if you outsource them.

- Time-consuming: Designing, conducting, and analyzing primary research can take significant time.

- Sample Bias: If your sample group isn’t representative of your target market, the data may not be reliable.

For a well-rounded understanding of your market, consider using a combination of both secondary and primary research methods. Leverage secondary research to gain a broad overview of the landscape, and then use primary research to get specific insights from your target audience. This two-pronged approach helps you validate existing data with real-world customer feedback.

How to Conduct Market Research for Startups

Conducting market research may seem daunting, but by following these steps, you can make the process manageable and effective:

Step 1: Define Your Research Goals (Think Laser Focus!)

Before diving headfirst into data collection, take a moment to crystallize what you want to achieve. Are you:

- Validating your idea? Is there a real need for your product or service?

- Understanding your target market? Who are your ideal customers, and what are their pain points?

- Analyzing the competition? Who are your main competitors, and what are their strengths and weaknesses?

Having clear goals ensures your research is focused and delivers actionable insights.

Step 2: Craft Your Buyer Persona

Imagine your perfect customer. What are their demographics (age, location, income)? What are their interests and online behavior? What problems do they face that your product or service can solve?

Getting Creative on a Budget:

- Leverage social media listening tools like Hootsuite or Sproutsocial to see what online communities your target audience frequents and what topics they discuss.

- Look for free online reports or surveys related to your industry. The U.S. Small Business Administration offers a wealth of free resources for startups.

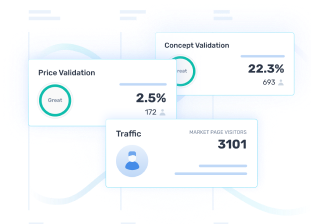

Did you know? Prelaunch is a concept-validating platform that gathers reliable information from people who actually interact with your product’s landing page AND creates realistic, reliable customer personas based on the analytics gathered.

Step 3: Choose Your Research Method

Startups often juggle limited budgets and tight timelines. Here’s where being resourceful comes in:

Secondary Research (Free & Fast)

Utilize resources like industry reports, government data (demographics, consumer spending habits), and market research databases (Statista, Euromonitor).

Example: You’re developing a fitness app for busy professionals. Secondary research might involve using Statista to understand the market size for fitness apps and exploring government data on health and wellness trends among working adults.

Primary Research (Gather In-Depth Insights)

Consider cost-effective methods like:

Online Surveys: Tools like SurveyMonkey or Google Forms allow you to gather quantitative data from a large sample size at minimal cost.

Targeted Social Media Polls: Leverage platforms like Facebook or Twitter to get quick feedback from your target audience.

Customer Interviews: Conduct video calls or in-person interviews with a few potential customers to gain qualitative insights into their needs and motivations.

Comprehensive primary research tools: Believe it or not there are concept validation platforms like Prelaunch that actually bring together surveys, interviews, and focus groups through a single landing page that lets you present your product to the world and use analytics to track how they engage, what price point they’re willing to pay, and what version of your product they’d most like to see. So you don’t max out your credit card before you’ve even launched, all-in-one tools like this are definitely worth a gander.

Step 4: Collect and Analyze Your Data

Once you have your data, the magic happens! Analyze it carefully, looking for patterns and trends that answer your research questions. Here are some tips:

- Quantitative Data (Surveys, Polls): Use tools like Google Sheets or Excel to organize and analyze your data. Look for trends in demographics, preferences, and pain points.

- Qualitative Data (Interviews): Transcribe your interviews and identify recurring themes. Look for emotional responses and specific language used by your target audience.

To get a more in-depth idea about the types of market research including the difference between quantitative and qualitative methods click here.

Step 5: Translate Insights into Action

This is where the rubber meets the road! Use your research findings to:

- Refine your product or service: Ensure it directly addresses the needs of your target market.

- Develop a targeted marketing strategy: Craft messaging and choose channels that resonate with your ideal customer.

- Set competitive pricing: Understand your competitors’ pricing models and position your product strategically.

Remember: Market research is an ongoing process. As your startup evolves, revisit your research and gather new data to stay ahead of the curve.

Bonus Tip: Don’t be afraid to get creative! There are many affordable online tools and resources available to help you conduct effective market research on a shoestring budget.

By following these steps and embracing a resourceful mindset, you can unlock the power of market research to propel your startup towards success!

Case Studies and Examples

As we explore the world of startup market research, we encounter unique methods and inspiring success stories. Our first case study is from Prelaunch, a concept-validating platform revolutionizing product development with virtual focus groups.

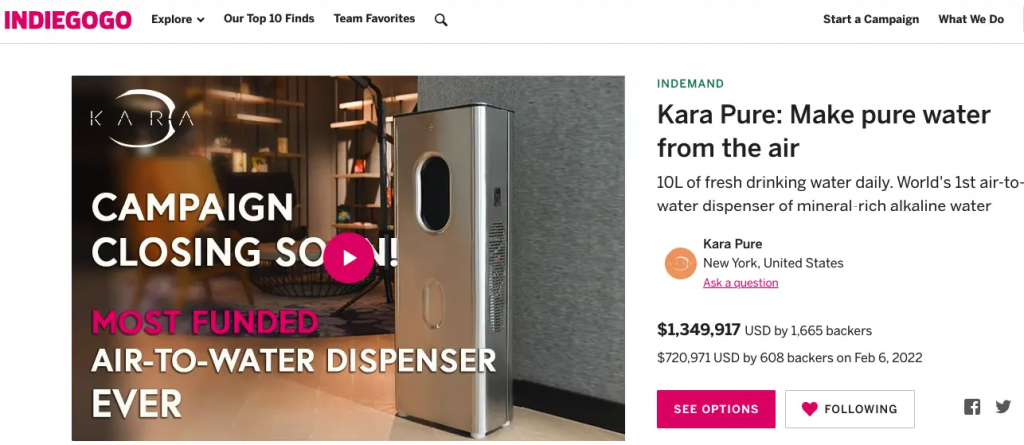

Case Study: Kara Pure’s Innovative Market Research

In the realm of groundbreaking startup launches, the story of Kara Pure stands out as a powerful testament to the value of prelaunch market research. By leveraging market research tools like Prelaunch, Kara Pure was able to successfully raise an impressive $1.3M on Indiegogo for their innovative air-to-water system.

The startup seized the power of data-driven decision making during their prelaunch stage. They executed various pricing models and tests to discern potential customers’ willingness to pay, ultimately identifying the optimal launch price of $999, a figure that encapsulated the unique value offering of their product.

The team at Kara Pure used the actionable insights derived from Prelaunch.com’s survey results to generate comprehensive buyer personas. This data was key in customizing communication to address each consumer segment’s unique desires and concerns, thereby significantly enhancing their message’s impact.

Additionally, they adopted a dynamic retargeting strategy along with a highly effective lead conversion funnel. These strategies catered to both broad and VIP audiences, yielding a significant return on investment. One particularly innovative strategy they employed was Live Lead Generation, a tactic that not only allowed them to maintain control over potential leads but also delivered one of the highest conversion rates known in the industry.

Kara Pure didn’t stop at digital strategies. They also integrated creative financing solutions, including a 3-month installment plan and secret perks for those who had returned their Initial pledges. Their successful product launch was further bolstered by maximising the use of social media, influencer marketing and public relations, all of which played a crucial role in enhancing their visibility and credibility.

Overall, the Kara Pure case study illuminates the undeniable importance of strategic communication, trust-building, and, most importantly, the effective use of market research tools in achieving startup success. Stay tuned for our next featured case study where we delve further into these essential market research strategies.

Case Study 2: Pico’s Kickstarter Campaign

Our second example spotlights the successful Kickstarter campaign for a project called Pico. This campaign not only faced notable challenges such as a saturated market and lack of prototypes, but it also managed to collect over $1.5 million in funding.

The secret behind this astounding success? Prelaunch market research tools and carefully curated strategies. The Pico team made use of various resources and techniques to ensure the highest possible outcomes for their campaign. They leveraged visual content, with photoshoots and badges echoing the aesthetic of Kickstarter, to captivate their audience.

Their marketing efforts didn’t stop at aesthetics; they also made use of advertising, influencer marketing, and social media maneuvering to bolster their brand awareness and heighten sales. However, central to their approach was the emphasis on customer engagement. They maximized their conversions through cross-promotions, a meticulous direct sales campaign, and personalized outreach to their backers.

Furthermore, their responsive approach to audience engagement, such as answering comments and promptly addressing payment issues, added to the campaign’s triumphant launch. The Pico example demonstrates the powerful impact of prelaunch market research tools, agile strategies, and ongoing optimization efforts in successfully launching a project.

Conclusion

Conducting market research is a critical step for any startup looking to succeed. By understanding your market, validating your ideas, and identifying opportunities, you can make informed decisions that pave the way for success. Remember, market research is an ongoing process—continuously gather and analyze data to stay ahead of the curve.

Ready to take your startup to the next level? Start your market research journey today and unlock the insights you need to thrive.

Frequently Asked Questions

1. What is the best form of market research for a new business startup?

There’s no single “best” form. The ideal approach depends on your specific research goals and budget. Here’s a breakdown:

- Start with Secondary Research: This is a cost-effective way to gain a broad understanding of your market landscape. Utilize industry reports, government data, and market research databases (like Statista or Euromonitor).

- Combine with Primary Research: Once you have a basic understanding, delve deeper with primary research methods like online surveys, social media polls, or targeted customer interviews. This provides richer insights into your specific target audience.

The key is to choose a combination of methods that fit your needs and resources.

2. What tools can help startups with market research?

Several online tools can streamline your market research process:

- Free Survey Tools: SurveyMonkey and Google Forms allow you to create and distribute surveys to gather quantitative data.

- Social Media Listening Tools: Platforms like Hootsuite or Sprout Social help you track online conversations about your industry and target audience.

- Free Market Research Resources: The U.S. Small Business Administration offers a wealth of free reports and data relevant to various industries.

- Freemium Market Research Tools: Some market research databases, like Statista, offer limited free data sets you can leverage.

3. How much does market research cost for a startup?

Market research costs can vary greatly. Here’s how to manage it as a startup:

- Focus on free resources: Utilize the many free tools and data sets available.

- Start small and scale up: Begin with basic research and expand as needed.

- Get creative: Conduct online polls, analyze social media trends, and conduct targeted customer interviews for valuable insights.