The retail industry is a bustling marketplace where competition is fierce and customer preferences are constantly evolving. To thrive and grow in such a dynamic environment, market research is not just beneficial – it’s a necessity. Retail market research involves gathering, analyzing, and interpreting data related to consumer behavior, market trends, and competitor strategies. For entrepreneurs, market analysts, and small business owners within the retail sector, understanding the specifics and best practices of retail market research can be a game-changer.

This comprehensive guide looks at the power of retail market research, how to approach it effectively, tools to simplify the process, featuring a case study, and tackle the challenges head-on.

What Makes Market Research for Retail Unique?

Market research in the retail industry is marked by several distinct features that set it apart from other sectors. Understanding these unique aspects is crucial in conducting research that yields actionable insights.

1. Hyper-focus on the Customer

Retailers are laser-focused on understanding their target customers. This goes beyond demographics to encompass shopping habits, preferences, and even emotional drivers behind purchases.

2. The Competitive Landscape

The retail world is crowded and fiercely competitive. Market research helps identify what competitors are doing well (or poorly) and allows retailers to differentiate themselves [4].

3. The Importance of Experience

In today’s retail world, the customer experience is paramount. Retail research goes beyond product desire and explores factors like store layout, online usability, and even employee interaction.

4. Keeping Up with Trends

Retail is a dynamic industry, and what’s hot today can be yesterday’s news tomorrow. Market research helps retailers identify emerging trends and adapt their offerings accordingly.

5. The Blend of Online and Offline

Modern retail isn’t just about brick-and-mortar stores or websites anymore. It’s a seamless blend of the two. Retail research needs to consider how these channels interact and how customers navigate between them.

By considering these unique aspects, retailers can leverage market research to make smarter decisions about everything from product selection to store layout and marketing campaigns.

How to Conduct Market Research for Retail Businesses [Step-by-Step Guide]

Effective retail market research is a systematic process that involves several key steps. By breaking down the process, you can conduct thorough research that informs smart business decisions.

Step 1: Define Your Research Goals & Target Audience

Goal Setting: What do you want to learn? Is it understanding customer preferences for a new product line, analyzing competitor strengths, or gauging interest in a new store location? Clearly defined goals will guide your research methods.

Target Audience: Who are you selling to? Define your ideal customer profile by demographics (age, income, location), interests, and shopping habits. This helps tailor your research methods to reach the right people.

Example: A clothing boutique wants to launch a new activewear line. Their target audience might be young professionals (22-35) who are health-conscious and shop online and in-store.

Step 2: Develop Your Research Plan

Primary vs. Secondary Research: As with any industry, primary research involves collecting your own data (surveys, interviews). Secondary research involves leveraging existing data (industry reports, government statistics).

Example: For the yoga wear example, primary research could involve focus groups with potential customers to understand their preferences for materials, styles, and price points. Secondary research might involve looking at industry reports on the growth of the eco-friendly clothing market.

Pro tip: Gathering primary research can cost you a lot of time and money. To better coordinate your efforts, make sure you use tools that do the leg work for you. For example, instead of creating templates and funneling all your findings manually into an Excel sheet, consider launching your product.

Prelaunching, i.e., creating a landing page with Prelaunch, opens up a world of insights into your target audience, best iterations of your product, and price point. All this information is neatly collected in a Dashboard, so all you have to do is analyze your data.

Step 3: Gather Your Information – Primary Research Methods

Surveys & Online Polls: Develop targeted online surveys or polls to gather customer opinions on product ideas, pricing, and brand perception. Tools like Google Forms or SurveyMonkey can help create and distribute these.

In-Store Observations: Observe how customers interact with your products or competitor products in physical stores. Note what attracts them, what they try on, and where they spend time.

Focus Groups: Conduct small group discussions with potential customers to gain deeper qualitative insights into their needs, motivations, and pain points.

Action Step: Merge the processes of surveys, online polls, and focus groups with a singular platform that helps you do it all. Setting up a concept-validating landing page on Prelaunch gives you access to real-time insights. Surveys are an embedded part of Prelaunch’s funnel.

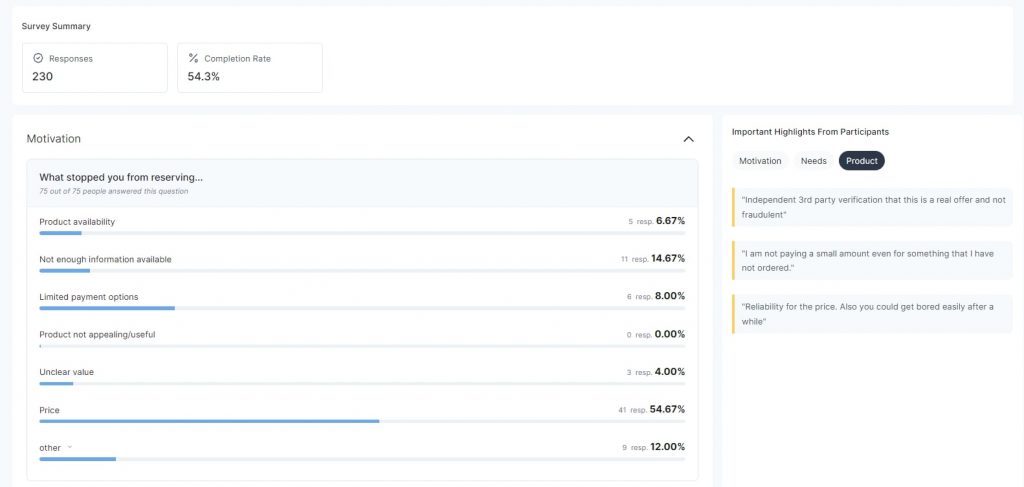

For instance, the Reservation Survey is displayed on the Thank You page following a potential customer’s reservation of the product. This enables you to pose questions aimed at enhancing the product and identifying the customer profile.

The Cancellation Survey is presented when someone selects the “No, thanks” option on the Reservation page. This offers insights into their reasons for not reserving the product and what changes could potentially change their mind.

The Prelaunch platform is also set up to conduct focus groups which can be organized remotely and from a group of potential buyers that have already confirmed their purchase intent. The result is the most accurate data you could ever wish for.

Step 4: Gather Your Information – Secondary Research Methods

Industry Reports: Look for reports from market research firms or industry associations that provide data on retail trends, consumer behavior, and market size for your specific niche.

National Retail Federation (NRF): Publishes annual reports on retail industry trends, consumer spending, and economic forecasts. They also offer specific reports on various retail sectors like grocery, apparel, or electronics.

Euromonitor International: Provides market research reports on various consumer goods sectors, including retail. Their reports offer in-depth analysis of market size, growth projections, and consumer trends across different regions.

McKinsey & Company: Produces research reports on retail industry disruption, e-commerce trends, and the future of shopping. Their insights are valuable for understanding the broader forces shaping the retail landscape.

Trade Publications: Stay updated on industry trends and competitor news by following relevant publications and websites.

Retail Dive: A leading online publication that covers retail news and trends across all sectors, from e-commerce to brick-and-mortar operations. They offer insightful articles, data analysis, and interviews with retail industry leaders.

Chain Store Age: A trade publication focused on news and strategies for multi-location retail chains. Their content covers topics like store operations, merchandising, and supply chain management.

STORES Magazine: Published by the National Retail Federation, STORES Magazine covers retail technology, marketing trends, and omnichannel strategies.

News Articles

- The Wall Street Journal – Retail & Wholesale: This section of the Wall Street Journal features news articles on major retail companies, industry mergers and acquisitions, and the impact of economic factors on the retail sector.

- Reuters Retail: Reuters provides breaking news and analysis on retail companies, consumer spending patterns, and global retail trends.

- Local Business Journals: Many local business journals (e.g https://www.bizjournals.com/) have sections dedicated to retail news within their specific metropolitan areas. These can provide valuable insights into consumer trends and local retail developments.

Action Step: Subscribe to newsletters from industry research firms like Nielsen or Euromonitor. Look for government data on the US Census Bureau website or your national statistical office.

Step 5: Analyze Your Findings

Organize your data: Put all your research findings (surveys, reports, observations) in a central location for easy analysis.

Identify trends and patterns: Look for recurring themes across your data sets.

Example: Analyze survey data to see if the price is a major concern for eco-conscious yoga wear consumers. Combine this with industry report data on the growing market for premium eco-friendly clothing.

Step 6: Present Your Findings and Take Action

Create a clear and concise report: Summarize your research methods, key findings, and actionable insights.

Develop a plan: Based on your research, decide what to stock, how to price products, and how to market your eco-friendly yoga wear line.

Example: Your research might reveal a strong demand for high-quality, ethically sourced yoga wear at a premium price point. This can guide your product selection, marketing message, and in-store presentation.

Pro tip: Actionable insights are easier to arrive at when you have Customer Personas. On Prelaunch, these are AI-developed personas based on the customer profiles that your campaign has provided. Simply put, when potential customers interact with your landing page, they provide clues and insights into the best way to market your product (e.g. what pain points they have, what features really make a difference.)

Based on these insights Prelaunch builds customer personas which give you a clear idea of who and how to target your marketing efforts.

Tools and Resources for Retail Market Research

Retailers today have an array of tools and resources at their disposal to carry out comprehensive market research. From traditional methods to cutting-edge analytics, choosing the right tools can make a significant impact on the quality and efficiency of your research.

Primary Research Methods

Surveys & Questionnaires: Gather a large pool of data on customer demographics, shopping habits, and brand preferences.

Tools: SurveyMonkey, Typeform, Google Forms

Focus Groups: Conduct guided discussions with a small group of customers to gain deeper insights and understanding of their motivations.

Tools: Prelaunch.com: This concept validation platform is a one-stop-shop for marketers. By creating a landing page with your concept and gauging customer response, you gain real-time insights into demand, iterate on your design based on feedback, and avoid investing heavily in an idea that might flop. This direct interaction with potential customers makes pre-launching a powerful primary research tool.

In-Store Observations: Observe how customers interact with your store or competitor stores. This can reveal product placement issues or areas where customer service can be improved.

Unfortunately, there aren’t many tools that can help optimize this process, which is why it’s imperative to optimize as many primary research methods as possible. (See pro tip above☝)

Secondary Research Methods

Industry Reports: Published by research firms or industry associations, these reports provide valuable data on market size, trends, and competitor analysis.

Resources: Euromonitor, Gartner L2, IBISWorld

Government Statistics: Government websites often provide demographic and spending data that can be helpful in understanding your target market.

Resources: US Census Bureau, UK Office for National Statistics

Competitor Analysis: Research your competitors’ offerings, pricing strategies, and marketing campaigns.

Tools: Similarweb, SEMrush

Social Media Listening: Monitor online conversations to understand customer sentiment and identify emerging trends.

Tools: Brandwatch, Sprout Social

Additional Resources

Retail Trade Associations: Many retail trade associations offer resources and research specific to your industry segment.

- National Retail Federation (NRF): The world’s largest retail trade association, offering resources and research on various retail sectors.

- Retail Industry Leaders Association (RILA): Represents leading retailers in the US, providing insights on public policy, consumer trends, and emerging technologies .

- International Council of Shopping Centers (ICSC): Focuses on shopping centers and real estate, offering data and reports on shopping center performance and consumer behavior.

- Grocery Manufacturers Association (GMA): Represents the food, beverage, and consumer product industry, providing insights on consumer trends and purchasing habits in the grocery sector.

News and Publications: Stay up-to-date on industry trends by following relevant publications and news websites.

- Retail Dive: Provides news and analysis on the retail industry, covering trends in e-commerce, omnichannel retailing, and technology.

- Chain Store Age: Offers news and insights for retail executives, covering topics like store operations, marketing, and technology.

- Supermarket News: Focuses on the grocery industry, providing news and analysis on trends, consumer behavior, and supply chain issues.

- Women’s Wear Daily (WWD): Covers the fashion and beauty industry, offering insights on consumer trends, fashion weeks, and retail strategies.

By combining these tools and resources, you can conduct comprehensive retail market research that empowers you to make strategic decisions and gain a competitive edge.

Case Study: Home Depot Leverages Market Research to Drive In-Store Tech Adoption

Challenge

Home Depot, a leading home improvement retailer, recognized the growing importance of technology in the customer journey. However, they needed to understand how customers interacted with technology in-store and how to encourage its adoption.

Research Methods

In-Store Observations: Researchers observed how customers navigated stores, interacted with kiosks and digital signage, and sought assistance from employees.

Customer Surveys: Surveys were conducted to understand customer attitudes towards technology in-store, their preferred ways to access information, and any pain points they encountered.

Focus Groups: Focus groups with DIY enthusiasts explored their comfort level with technology and their ideal in-store tech experience.

Key Findings

Customers were receptive to using technology in-store, especially for tasks like product research, checking inventory, and accessing project guides.

Traditional methods of getting help, like flagging down employees, were still important, but customers appreciated the ability to access information independently through kiosks and digital signage.

There was a gap between customer needs and existing technology offerings. The in-store tech felt clunky and not user-friendly for some customers.

Actions Taken

Improved In-Store Kiosks: Home Depot upgraded their kiosks with a more intuitive interface and a wider range of functionalities, allowing customers to browse products, compare features, and access how-to videos.

Enhanced Digital Signage: Digital signage was revamped to display targeted product information, special promotions, and DIY project inspiration, aligned with the customer’s location in the store.

Employee Training: Employees were trained on the new technology and empowered to guide customers towards using the kiosks and digital signage for a more efficient shopping experience.

Results

Increased Customer Satisfaction: Surveys showed a significant increase in customer satisfaction with the in-store shopping experience, particularly regarding ease of finding information and getting help.

Improved Sales Conversion: Data indicated that customers who interacted with the in-store technology were more likely to purchase.

Enhanced Brand Image: Home Depot positioned itself as a leader in integrating technology to improve the customer experience in the home improvement sector.

Lessons Learned

This case study highlights the importance of market research in understanding customer needs and effectively integrating technology in a traditional retail setting. By actively listening to their customers, Home Depot identified opportunities to bridge the gap between traditional and digital shopping experiences, ultimately leading to increased customer satisfaction and sales.

Cracking the Code: Overcoming Challenges in Retail Market Research

Retail market research is essential for staying ahead of the curve in this dynamic industry. However, gathering valuable customer insights can be tricky. Here, we explore some common challenges and how to overcome them:

Challenge 1: Capturing Elusive Customers

The Problem: Today’s consumers are busy and have short attention spans. Traditional methods like in-person surveys can have low response rates.

The Solution: Embrace online research tools like Prelaunch.com’s Idea Validation feature. The tool allows you to put together a sharable page that sums up and presents your product to an audience. The process takes less than 10 minutes and lets you capture your idea in a way that’s short, sweet and to the point. Based on how they engage with the page, you’ll be able to know whether your idea is valid or not.

Challenge 2: Keeping Pace with Change

The Problem: Retail trends evolve rapidly. Research based on outdated data can lead to missed opportunities.

The Solution: Build a culture of continuous research. Conduct regular pulse surveys to track changing preferences and use social listening tools to monitor online conversations about your brand and industry.

Challenge 3: Omnichannel Mystery

The Problem: The retail journey spans multiple channels – online stores, physical stores, and mobile apps. Understanding customer behavior across these touchpoints can be complex.

The Solution: Employ a mix of research methods. Combine online surveys with website behavior tracking and in-store observation to get a holistic view of the customer experience.

Challenge 4: Data Overload & Analysis Paralysis

The Problem: With so much data available, it can be overwhelming to analyze it effectively and translate insights into actionable steps.

The Solution: Invest in data analytics tools. These tools can help you categorize, visualize, and identify key trends within your data sets. Focus on creating clear research questions to guide your analysis and prioritize actionable insights.

By understanding these challenges and implementing the suggested solutions, you can ensure your retail market research delivers valuable insights that drive better business decisions and keep your brand at the forefront of the ever-evolving retail landscape.

Conclusion

Retail market research is not a one-size-fits-all endeavor. It requires adaptability, creativity, and a commitment to understanding the intricate interaction between markets and consumers. By following the steps provided in this guide and combining it with the right tools and resources, you can unlock invaluable insights that will drive your retail business forward.

Remember that conducting comprehensive retail market research is an investment, not an expense. It is the foundation upon which successful retail strategies are built. By immersing yourself in the data and understanding the unique characteristics of retail market research, you are taking the first steps towards securing your position in the competitive retail industry.

Emerge as a leader in your segment by harnessing the power of retail market research. Your strategies should not only reflect market realities but should also anticipate and shape them. Take the time to master this critical component of retail, and watch as your business flourishes in response. Happy analyzing!

FAQs

What is retail market research?

Retail market research is the systematic process of gathering information about the retail industry, specifically focusing on your target market and competitors. It helps you understand what customers want and need, how they shop, and what influences their buying decisions.

Who should conduct retail market research?

Ideally, anyone involved in making strategic decisions for a retail business can benefit from market research. This can include:

- Business Owners and Managers: Gain insights to improve product selection, pricing strategies, marketing campaigns, and overall customer experience.

- Marketing and Sales Teams: Understand customer needs and preferences to develop targeted marketing initiatives and improve sales conversion rates.

- Product Development Teams: Inform product development decisions based on real customer needs and emerging trends.

While some larger companies might have dedicated market research teams, smaller retailers can still conduct valuable research using a mix of free and paid tools and resources.

What types of market research are most appropriate for the retail industry?

Retail market research can leverage various methods, but some are particularly well-suited for the industry:

Primary Research: This involves collecting your own data directly from your target audience.

Examples: Customer surveys and questionnaires to understand shopping habits and preferences. Focus groups to gain deeper insights into customer motivations and product perceptions. In-store observations to analyze customer behavior and identify areas for improvement.

Secondary Research: This involves leveraging existing data collected by others.

Examples: Industry reports on market size, trends, and competitor analysis. Government statistics on demographics and spending habits in your target market. Competitor analysis to understand their offerings, pricing strategies, and marketing tactics. Social media listening to monitor online conversations and identify customer sentiment towards your brand and industry trends.

By combining primary and secondary research methods, retailers can gain a well-rounded understanding of their market and make informed decisions for long-term success.