Did you know that 99% of successful businesses use data to drive their decisions? In our increasingly digital world, quantitative market research has become an essential tool. It doesn’t just provide random facts; it offers precise insights into consumer behavior, market trends, and competitive landscapes, giving businesses the edge they need to storm ahead.

This article explores the fundamentals, methods, and applications of quantitative market research, helping business owners, marketing professionals, and entrepreneurs improve their decision-making and drive their businesses forward.

What is Quantitative Market Research?

Quantitative market research is a methodical approach to gather and analyze numerical data, offering businesses a practical understanding of customer behavior and market trends.

This can be part of both primary and secondary market research. Quantitative market research predominantly relies on structured tools like surveys, polls, and questionnaires to collect quantifiable pieces of information such as percentages, frequencies, and ratings. This research is carried out on a large, representative sample of the target audience to ensure accurate reflection of widespread attitudes and behaviors.

Following the data collection, statistical techniques are applied to reveal patterns, track trends, and identify relationships, effectively converting raw data into actionable insights to guide marketing strategies.

Quantitative vs. Qualitative Research

To fully appreciate quantitative research, it’s essential to understand how it differs from qualitative market research:

| Aspect | Quantitative Research | Qualitative Research |

| Data Type | Numerical | Textual, visual |

| Sample Size | Large | Small |

| Data Collection | Structured surveys, experiments | Interviews, focus groups, observations |

| Analysis | Statistical | Interpretive |

| Outcome | Generalizable findings | In-depth insights |

| Question Types | Closed-ended | Open-ended |

| Flexibility | Low (standardized approach) | High (adaptable to responses) |

While quantitative research provides broad, generalizable insights, qualitative research offers deeper, context-rich understanding. Many successful market research strategies combine both approaches to gain a comprehensive view of the market.

Applications of Quantitative Market Research

Quantitative market research finds applications across various business functions and industries. Here are some key areas where this research method proves invaluable:

Product Development

- Measuring consumer preferences for product features: This involves surveying potential customers to rank or rate different product features, helping companies prioritize which features to include or improve.

- Assessing market demand for new products: Researchers can use quantitative methods to estimate the potential market size and gauge consumer interest in a new product concept before investing in development.

- Evaluating pricing strategies: Through techniques like conjoint analysis or price sensitivity meters, companies can determine optimal price points that maximize both sales and profitability.

Brand Management

- Tracking brand awareness and perception: Regular surveys can measure how many consumers recognize a brand and what associations they have with it, allowing companies to monitor their brand’s health over time.

- Measuring brand loyalty and customer satisfaction: Quantitative research can assess how likely customers are to repurchase or recommend a brand, providing insights into customer retention strategies.

- Comparing brand performance against competitors: Competitive benchmarking surveys can reveal a brand’s strengths and weaknesses relative to competitors in various attributes.

Customer Segmentation

- Identifying distinct customer groups: By analyzing survey data on demographics, behaviors, and preferences, researchers can use cluster analysis to group customers with similar characteristics.

- Determining the size and value of different market segments: Once segments are identified, quantitative research can estimate the size of each segment and its potential value to the business.

Advertising Effectiveness

- Measuring ad recall and recognition: Surveys conducted after ad campaigns can quantify how many people remember seeing an ad and can correctly identify the brand associated with it.

- Assessing the impact of advertising on purchase intent: Researchers can measure how exposure to ads influences consumers’ likelihood to buy a product, helping to justify advertising spend.

- Evaluating return on investment for marketing campaigns: By linking advertising exposure data with sales data, companies can calculate the ROI of their marketing efforts.

Market Sizing and Forecasting

- Estimating market size and growth potential: Using survey data and secondary sources, researchers can quantify the current market size and project future growth based on trends and economic factors.

- Projecting future sales and market share: Time series analysis and regression models can be used to forecast a company’s sales and market share based on historical data and market conditions.

Customer Experience

- Measuring customer satisfaction and loyalty: Regular surveys can track customer satisfaction scores and Net Promoter Scores (NPS) to gauge overall customer sentiment and loyalty.

- Identifying pain points in the customer journey: Quantitative analysis of customer feedback can highlight common issues or areas of dissatisfaction in the customer experience.

- Quantifying the impact of service improvements: By measuring customer satisfaction before and after implementing changes, companies can assess the effectiveness of their improvement initiatives.

Competitive Analysis

- Benchmarking product or service performance: Surveys can compare how a company’s offerings stack up against competitors on various attributes, helping identify areas for improvement.

- Assessing market share and competitive positioning: Regular tracking studies can monitor changes in market share and brand positioning relative to competitors, informing strategic decisions.

Benefits and Challenges of Quantitative Market Research

Quantitative market research offers a range of advantages that make it a valuable tool for businesses seeking data-driven insights. Understanding these benefits can help organizations leverage this research method effectively to inform their strategies and decision-making processes.

Benefits

Objectivity: Quantitative research provides unbiased, numerical data that can be statistically analyzed. This objectivity ensures that the findings are not influenced by the researcher’s personal biases or perspectives.

Generalizability: Results derived from large sample sizes can be extrapolated to represent the broader population. This means that the findings are more likely to be valid for all individuals within the target group, enhancing the reliability of the study.

Comparability: Standardized data collection methods allow for easy comparison across different time periods or market segments. This comparability is crucial for tracking changes and trends over time, as well as for identifying differences between various subgroups.

Scalability: Quantitative research methods can efficiently gather data from large sample sizes. This scalability makes it possible to conduct studies on a much larger scale, providing more comprehensive insights into the research question.

Hypothesis testing: Quantitative research enables researchers to test specific theories or assumptions about market behavior. By confirming or disproving these hypotheses, researchers can gain a deeper understanding of the factors driving market trends and consumer behaviors.

Decision support: The concrete data obtained from quantitative research provides a solid foundation to support strategic decision-making. This evidence-based approach facilitates more informed and effective decisions, reducing the risk of error and improving outcomes.

While quantitative market research provides numerous advantages, it’s important to recognize that this approach also comes with its own set of limitations and potential pitfalls. Being aware of these challenges can help researchers and businesses plan more effectively and interpret results with appropriate caution.

Challenges

Limited depth: Quantitative research methods may not capture the nuanced reasons behind consumer behavior or attitudes, often resulting in a superficial understanding of complex issues.

Inflexibility: Structured surveys and experiments may miss unexpected insights that could emerge in more open-ended research methods, limiting the scope of discovery.

Response bias: Respondents may not always provide honest or accurate answers, particularly on sensitive or personal topics, leading to skewed data and unreliable conclusions.

Cost: Conducting large-scale surveys or experiments can be expensive, often requiring significant financial resources for data collection, participant incentives, and analysis.

Time-consuming: The proper design, implementation, and analysis of quantitative research can be time-intensive, potentially delaying the results and impacting project timelines.

Expertise required: Quantitative research requires extensive knowledge of statistical analysis and research methodologies, necessitating skilled professionals to ensure accurate and reliable outcomes.

Examples of Quantitative Market Research

To illustrate the practical applications of quantitative market research, let’s explore some real-world examples:

Netflix A/B Testing Titles

Ever noticed how Netflix displays different titles or artwork for the same movie or show depending on your profile? This is A/B testing, a form of quantitative research. Netflix uses surveys and click-through rates to determine which title or artwork generates the most clicks and engagement.

Spotify Optimizing Playlists

How does Spotify create those eerily perfect playlists that seem to know exactly what you’re in the mood for? Quantitative research plays a role! Spotify analyzes user listening habits, including skip rates, play time, and song popularity, to curate playlists that resonate with different user preferences.

Coca-Cola Testing New Flavors

Developing a new beverage flavor requires understanding consumer preferences. Coca-Cola uses surveys and taste tests to gather quantitative data on sweetness levels, flavor combinations, and overall appeal. This data helps them refine new flavors before a full-scale launch.

Apple gauging iPhone Screen Size Preferences

Before increasing iPhone screen sizes, Apple likely conducted quantitative research. Online surveys and focus groups could have gathered data on user preferences for screen size, one-handed usability, and content viewing experience. This data likely helped Apple determine the optimal screen size for future iPhones.

Dominos Revamping its Pizza Recipe

In 2009, Domino‘s faced declining sales. Quantitative research came to the rescue. Domino’s conducted customer surveys and taste tests to understand customer dissatisfaction with its pizza crust and sauce. Based on the findings, they revamped the recipe, leading to a significant turnaround in customer satisfaction and sales.

These are just a few examples, but they showcase the power of quantitative research in helping businesses make data-driven decisions that resonate with their target audiences.

Tools and Resources for Quantitative Research

To conduct effective quantitative market research, consider utilizing these tools and resources:

Survey Platforms

Qualtrics: Comprehensive survey software with advanced analytics

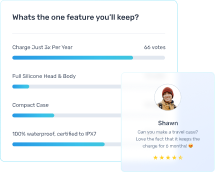

Prelaunch: Lets you gather data via a landing page that concisely presents your product

SurveyMonkey: User-friendly platform for creating and distributing surveys

Google Forms: Free tool for basic surveys and data collection

Statistical Analysis Software

SPSS: Powerful software for complex statistical analysis

R: Open-source programming language for statistical computing

Prelaunch: The platform is a comprehensive concept-validating tool that complies and presents the data you gather via your product’s landing page into insightful section that make it easier to make data-driven decisions.

Excel: Suitable for basic data analysis and visualization

Online Panel Providers

Dynata: Large global panel for diverse respondent recruitment

Amazon Mechanical Turk: Platform for crowdsourcing survey participants

Data Visualization Tools

Tableau: Creates interactive data visualizations and dashboards

Power BI: Microsoft’s business analytics tool for data visualization

Datawrapper: User-friendly tool for creating charts and maps

Market Research Associations

ESOMAR: Global voice of the data, research, and insights community

Insights Association: Leading voice, resource, and network of the marketing research and data analytics community

Academic Resources

Journal of Marketing Research: Scholarly journal featuring cutting-edge research methodologies

Market Research Society (MRS): Provides training, qualifications, and resources for market researchers

Remember to choose tools that align with your research objectives, budget, and level of expertise. Many of these platforms offer free trials or basic versions, allowing you to experiment before committing to a paid solution.

Conclusion

Quantitative market research is a powerful tool for making data-driven decisions. By providing objective, measurable insights into consumer behavior and market trends, it helps businesses develop targeted strategies and stay ahead of the competition.

While it has its limitations, combining quantitative methods with qualitative approaches can offer a comprehensive market understanding. Careful planning, rigorous methodology, and thoughtful interpretation of results are key to successful quantitative research.

Embrace the power of numbers and let data guide your business success.