In the fast-paced world of innovation, having a brilliant idea is just the beginning. The real challenge? Making sure that idea has legs. Enter idea validation – your secret weapon for turning “What if?” into “Let’s do this!”

What Is Idea Validation?

Idea validation is the process of testing your product concept in the real world before you invest significant time and resources into development. It’s like dipping your toe in the water before diving headfirst into the pool of entrepreneurship. This crucial step helps you gauge market interest, identify potential pitfalls, and refine your concept based on actual user feedback.

Why is Idea Validation Important?

Picture this: You’ve poured your heart, soul, and life savings into developing a revolutionary app for left-handed ukulele players, only to discover that the market consists of exactly three people (and one of them is your cousin). Ouch. This is where idea validation swoops in to save the day – and your bank account.

Martin Oxley, former managing director of BuzzBack Europe, stresses the importance of accessing the underlying emotions and motivations of customers, rather than just their rational responses. This approach can be crucial in validating both the target customer and the problem they’re facing.

Idea validation isn’t just a nice-to-have; it’s a critical component of successful product development and business strategy. Let’s dive deeper into why it’s so crucial:

Risk Reduction

By validating your idea early, you minimize the chances of building something nobody wants. This is perhaps the most significant benefit of idea validation. According to a CB Insights report, 42% of startups fail due to a lack of market need for their product. Idea validation helps you identify potential pitfalls before you invest substantial resources, allowing you to pivot or abandon ideas that don’t resonate with your target market.

Resource Optimization

Time and money are precious commodities for any business, especially startups. Idea validation helps you allocate these resources more efficiently by focusing on ideas with proven potential. Instead of spending months or years developing a product based on assumptions, you can use validation techniques to test your hypotheses quickly and cheaply. This lean approach allows you to fail fast and learn fast, ultimately leading to better resource allocation.

Market Insights

The validation process provides invaluable information about your target audience and their needs. Through surveys, interviews, and prototype testing, you gain firsthand knowledge of your potential customers’ pain points, preferences, and behaviors. These insights can help you refine your product features, adjust your marketing strategy, and even identify new market opportunities you hadn’t considered initially.

Competitive Edge

Understanding the competitive landscape is crucial for any new product. Idea validation forces you to research existing solutions and identify gaps in the market. This knowledge allows you to position your product more effectively, highlighting your unique value proposition. Moreover, by engaging with potential customers early, you can build relationships and create buzz around your product before it even launches.

Investor Confidence

If you’re seeking external funding, having a validated idea can significantly boost your chances of success. Investors are more likely to back projects that have demonstrated market potential and user interest. Validation data provides concrete evidence to support your business plan, making your pitch more compelling and credible.

Product-Market Fit

Achieving product-market fit is the holy grail of product development. Idea validation helps you work towards this goal from the very beginning. By iterating based on real user feedback, you can refine your product to better meet market needs, increasing the likelihood of achieving that perfect fit between your offering and customer demands.

Customer-Centric Development

Idea validation puts your potential customers at the center of the development process. This customer-centric approach often leads to better products that truly solve user problems. It also helps build a loyal customer base early on, as people appreciate being involved in the development process and seeing their feedback implemented.

Flexibility and Adaptability

The validation process often reveals unexpected insights that can lead to pivots or new ideas. By staying open to feedback and willing to adapt, you can evolve your initial concept into something even more valuable. This flexibility is a key attribute of successful entrepreneurs and businesses in today’s fast-changing market.

Building Team Confidence

For startups and new projects within larger organizations, idea validation can help build team morale and confidence. When team members see tangible evidence that their idea has potential, it can boost motivation and commitment to the project.

Regulatory and Ethical Considerations

In some industries, idea validation can help identify potential regulatory hurdles or ethical concerns early in the process. This foresight can save you from investing in ideas that may face significant legal or societal barriers down the line.

Remember, the goal of idea validation isn’t to prove that your idea is perfect. Instead, it’s about learning, adapting, and creating something truly valuable for your customers. By embracing this process, you’re setting yourself up for a smoother journey from ideation to market success.

Steps to Validate an Idea

Ready to put your idea through its paces? Follow these steps to validate like a pro:

1. Define Your Hypothesis

The first step in idea validation is clearly articulating what problem your idea solves and for whom. This involves creating a hypothesis that outlines your assumptions about your product and its market.

- Identify the specific problem you’re addressing

- Define your target audience in detail

- Articulate how your solution solves the problem

- Outline your key assumptions about the market and user behavior

Example: “We believe that freelance designers (target audience) struggle with managing their finances (problem). Our AI-powered bookkeeping app (solution) will help them track expenses, invoice clients, and prepare for taxes more efficiently, saving them 10 hours per month (value proposition).”

2. Market Research

Dive deep into your target market to understand the landscape you’re entering. This step involves both primary and secondary research.

- Secondary Research:

- Analyze industry reports and market trends

- Study competitor offerings and their market share

- Look into relevant regulations or technological advancements

- Primary Research:

- Conduct surveys or interviews with potential customers

- Engage in online communities where your target audience gathers

- Attend industry events or trade shows

Use tools like Google Trends, industry-specific databases, and social media listening tools to gather data. The goal is to understand the market size, growth potential, and current solutions available.

3. Create a Minimum Viable Product (MVP)

Develop a basic version of your product with just enough features to be usable by early customers. The MVP should be designed to test your core value proposition.

- Identify the core features that solve the main problem

- Design a simple user interface or prototype

- Use tools like Figma or Adobe XD for digital prototypes

- For physical products, consider 3D printing or handmade prototypes

Remember, the MVP doesn’t need to be perfect. It’s a tool for learning, not the final product.

4. Gather Feedback

This is where the rubber meets the road. Use various methods to collect honest opinions about your MVP.

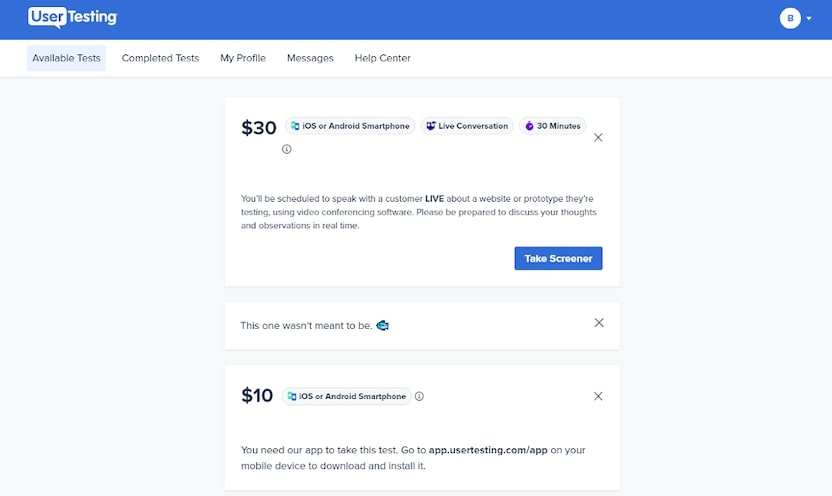

- User Testing:

- Conduct one-on-one user testing sessions

- Use tools like UserTesting.com for remote user testing

- Observe users interacting with your MVP and note their behavior

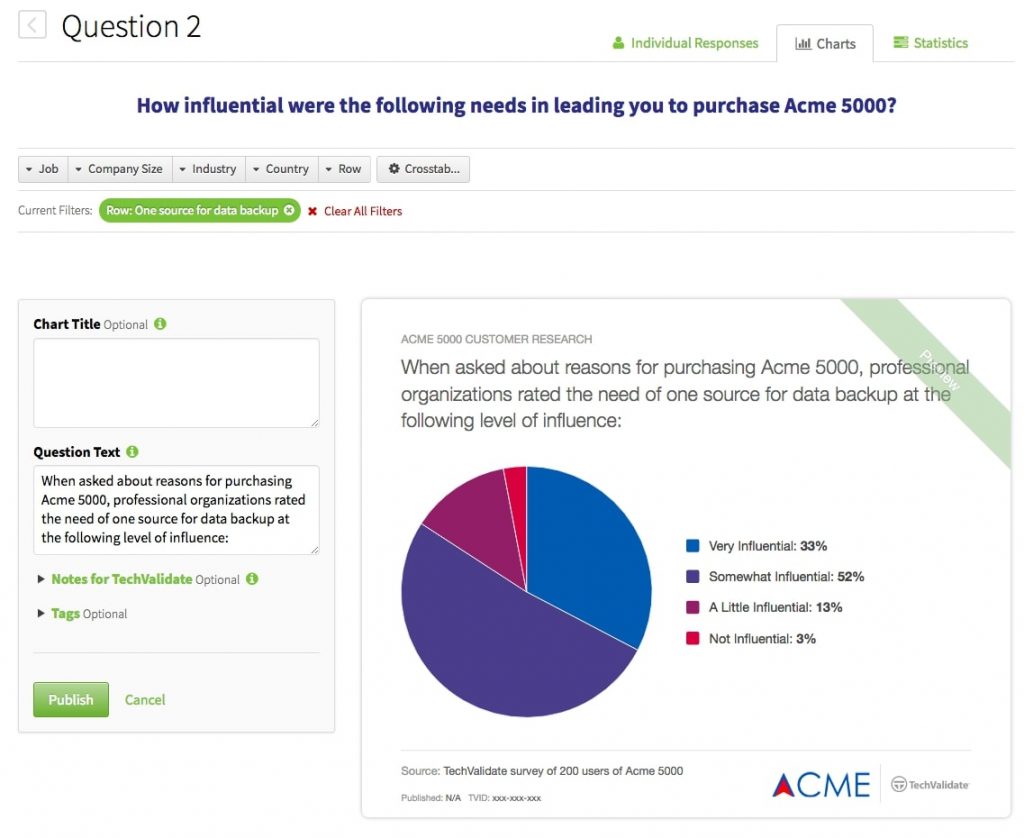

- Surveys:

- Create targeted surveys using tools like SurveyMonkey or Google Forms

- Ask both quantitative and qualitative questions

- Focus on understanding user pain points and how well your solution addresses them

- Interviews:

- Conduct in-depth interviews with potential users

- Use open-ended questions to encourage detailed responses

- Pay attention to non-verbal cues and emotional responses

5. Analyze Data

Look for patterns in the feedback. Are people excited about your idea? What concerns do they have?

- Quantitative Analysis:

- Look at metrics like user engagement, task completion rates, or survey scores

- Use statistical tools to identify significant trends

- Qualitative Analysis:

- Code and categorize open-ended responses

- Identify recurring themes or pain points

- Look for unexpected insights or use cases

- Synthesize Findings:

- Create user personas based on your research

- Develop customer journey maps

- Identify key areas for improvement or pivot opportunities

6. Iterate and Improve

Use the insights you’ve gained to refine your concept. This might involve:

- Adjusting your target audience

- Refining your value proposition

- Adding, removing, or modifying features

- Changing your pricing strategy

- Pivoting to a different solution altogether

Martin notes, “The iterative approach can be particularly useful in idea validation, allowing researchers to continually refine their understanding of the target market and the issues they face.”

7. Test Pre-launch Interest

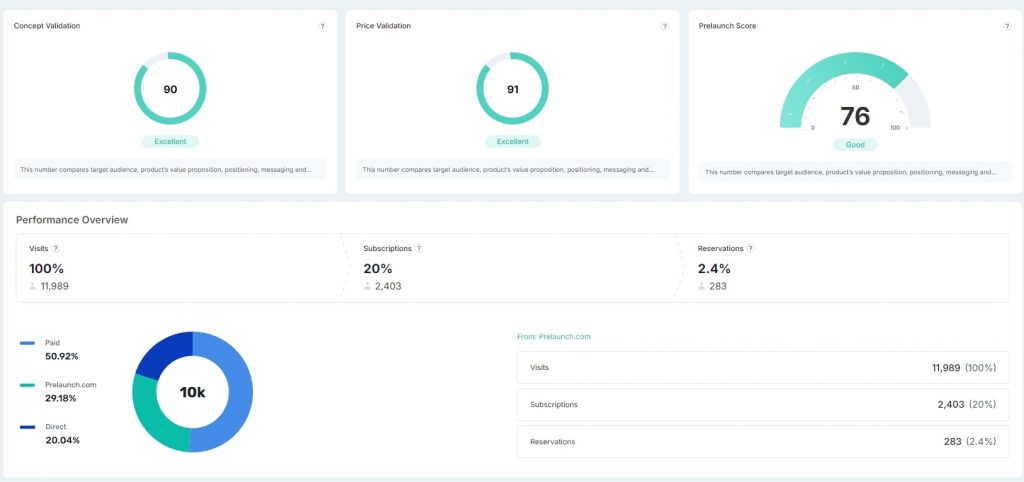

Before fully committing to development, test real-world interest in your product.

- Create a Landing Page:

- Use tools like Prelaunch to create a compelling landing page

- Include key features, benefits, and a clear call-to-action

- Use A/B testing to optimize conversion rates

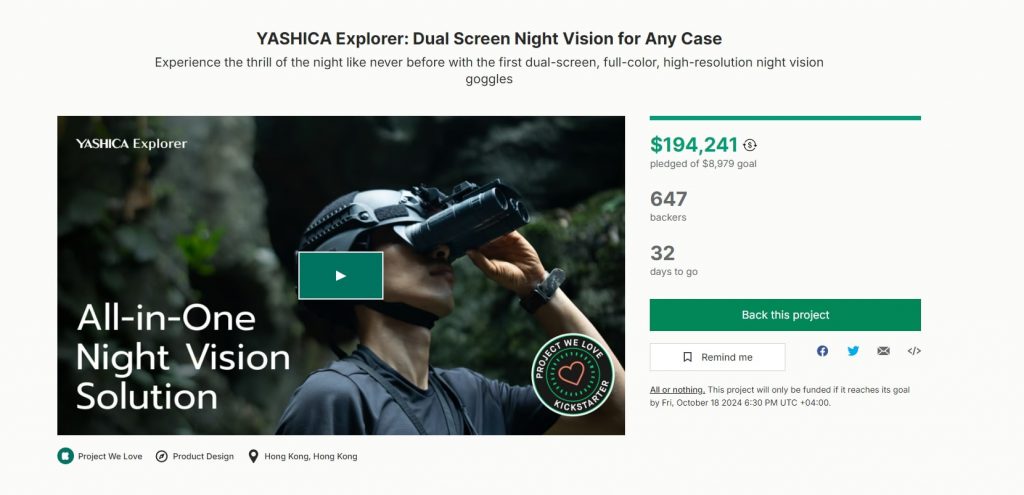

- Run a Crowdfunding Campaign:

- Platforms like Kickstarter or Indiegogo can gauge interest and secure early adopters

- Set realistic funding goals and offer compelling rewards

- Pre-sales or Beta Sign-ups:

- Offer early-bird discounts or exclusive access to generate interest

- Track sign-up rates and engagement metrics

8. Make the Go/No-Go Decision

Based on your validation results, it’s time to make a crucial decision.

- Go: If validation results are positive, start planning for full development and launch

- Pivot: If results are mixed, consider how you can adjust your idea to better meet market needs

- No-Go: If validation consistently shows lack of interest or feasibility, be prepared to shelve the idea and move on to the next opportunity

Remember, deciding not to proceed with an idea is not a failure – it’s a valuable learning experience that saves you from bigger losses down the line.

By following these steps, you create a structured approach to idea validation that minimizes risks and maximizes your chances of developing a product that truly resonates with your target market.

Idea Validation Tools

Streamline your validation process with these powerful tools, each designed to provide unique insights into your market and idea potential:

Prelaunch: Prelaunch is a comprehensive platform that offers an all-in-one solution for idea validation. It provides:

- Landing page creation tools to test your concept

- A/B testing capabilities to optimize your messaging

- Audience insights to understand your target market

- Pre-order functionality to gauge real purchase intent

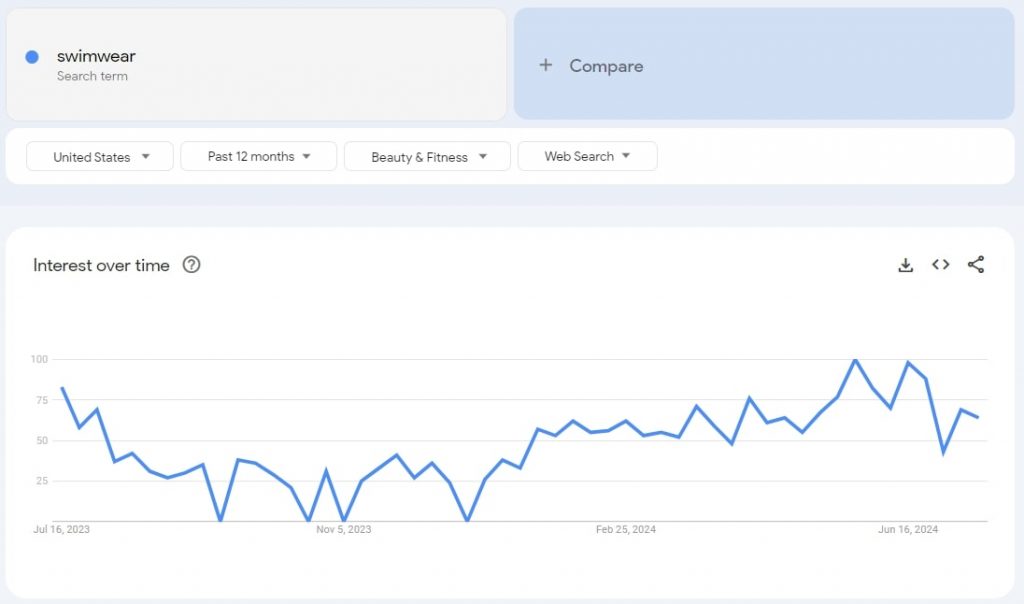

Google Trends: This free tool from Google allows you to:

- Analyze search volume for keywords related to your idea

- Compare interest over time for different concepts

- Explore regional interest to identify potential target markets

- Discover related topics and queries for further research

SurveyMonkey: SurveyMonkey is a versatile survey platform that enables you to:

- Create customized surveys with various question types

- Distribute surveys to your target audience via multiple channels

- Analyze results with built-in reporting tools

- Gather quantitative data to support your validation process

UserTesting: This platform connects you with real users who can test your prototype or concept. Benefits include:

- Live feedback from your target demographic

- Video recordings of users interacting with your product

- Detailed insights into user behavior and preferences

- Ability to iterate quickly based on user feedback

Kickstarter/Indiegogo: These crowdfunding platforms serve as powerful validation tools by allowing you to:

- Present your idea to a large, innovation-friendly audience

- Secure early adopters and validate market interest

- Raise funds for further development

- Build a community around your product before launch

By leveraging these tools, you can gather comprehensive data and insights to validate your idea from multiple angles. Remember, the key is to use a combination of these tools to get a well-rounded view of your idea’s potential in the market.

Tips from Industry Experts

Navigating the world of idea validation can be challenging, but you don’t have to do it alone. Let’s dive into some invaluable advice from industry experts who have been through the process and come out successful on the other side.

Avoid Asking Direct Questions About Product Improvements

Martin Oxley, former managing director of BuzzBack Europe, advises against asking direct questions about product improvements, saying, “You should never ask questions that are direct, ‘how would you improve this?’ Because often you’ll say, ‘Well, make it cheaper.’ And so you don’t want to misdirect someone just because you’ve asked bad questions that are purely a rational response.”

Fall in Love with the Problem, Not the Solution

Uri Levine, Co-founder of Waze, emphasizes the importance of focusing on the problem you’re solving rather than getting attached to a specific solution. This mindset allows for greater flexibility and innovation in your approach. Practical Application:

- Regularly revisit and refine your problem statement

- Be open to pivoting your solution as you learn more about the problem

- Conduct ongoing research to deepen your understanding of the issue

Don’t Ask Your Mom if Your Business Idea is Good

Many innovators will point out the importance of getting unbiased feedback. Friends and family might be too kind in their assessment. Practical application:

- Seek feedback from your target market, not just those close to you

- Use anonymous surveys or third-party user testing services for honest opinions

- Be prepared for and welcome critical feedback

Make it Easy for People to Give You Money

Validating willingness to pay early in the process is also critical. That’s why Prealunch has a specific feature that allows you to test for the optimal price. Practical application:

- Include pricing information in your MVP or landing page

- Experiment with pre-orders or crowdfunding to gauge payment intent

- Analyze how different price points affect interest and conversion rates

Your First Idea is Almost Always Wrong. Embrace the Pivot

Eric Ries, author of “The Lean Startup,” reminds us that initial ideas rarely survive contact with real customers unchanged. Being prepared to pivot based on feedback is crucial. Practical application:

- Approach your idea as a series of hypotheses to be tested

- Set clear metrics for success and be prepared to change course if they’re not met

- Celebrate learning and iteration as signs of progress, not failure

Get Out of the Building

This famous advice from Steve Blank underscores the importance of real-world validation over theoretical planning. Practical application:

- Attend industry events and trade shows to meet potential customers

- Conduct field research to observe how people currently solve the problem you’re addressing

- Use pop-up shops or demos to get real-time feedback on your product

Focus on Early Adopters

It might seem overly obvious, but it’s true. Focus on early adopters during the validation phase. Practical application:

- Identify and target the most forward-thinking segment of your market

- Tailor your messaging and outreach to appeal to these early adopters

- Use their feedback to refine your product before targeting the broader market

Validate the Problem, Then the Solution

Many see validation as a two-step process: first ensuring you’re addressing a real problem, then validating your specific solution. Practical application:

- Conduct problem interviews before pitching your solution

- Use techniques like the “concierge MVP” to manually solve the problem before building a product

- Iterate on your solution based on how well it solves the validated problem

Use Cohort Analysis for Deeper Insights

Consider using cohort analysis to understand user behavior over time. Practical application:

- Track how different groups of users interact with your MVP over time

- Use tools like Mixpanel or Google Analytics to set up cohort analysis

- Look for patterns in retention and engagement to guide product development

Don’t Forget About Emotion

Successful products often tap into emotional needs beyond just functional benefits. Keep in mind that decisions are made “in the moment” and rooted in feelings. Practical application:

- Explore the emotional drivers behind your users’ needs

- Incorporate questions about feelings and aspirations in your user research

- Consider how your product can create positive emotional experiences

By incorporating these expert tips into your validation process, you’ll be better equipped to navigate the challenges of bringing a new idea to market. Remember, the key is to stay curious, remain adaptable, and always keep your users at the heart of your validation efforts.

Conclusion

Idea validation isn’t just a step in the product development process – it’s your secret sauce for success. By rigorously testing your concept before going all-in, you’re setting yourself up for a smoother journey from ideation to market domination. Remember, the goal isn’t to prove your idea is perfect; it’s to learn, adapt, and create something truly valuable for your customers.

FAQs

How do I know if my idea needs validation?

If you’re asking this question, your idea probably needs validation! Any new product or service concept should go through some form of validation to minimize risks and maximize potential for success.

How to quickly validate an idea?

For rapid validation, create a simple landing page describing your idea and use paid ads to drive traffic. Measure interest through sign-ups or pre-orders. Combine this with quick user interviews for qualitative insights.

How long does the idea validation process take?

The timeline can vary widely depending on the complexity of your idea and the depth of validation needed. A basic validation could take a few weeks, while more comprehensive validation might take several months.

What should I do if my idea doesn’t pass the validation process?

Don’t despair! Use the insights you’ve gained to pivot your idea or explore new concepts. Remember, many successful products evolved significantly from their original concept based on validation feedback.