The technology industry’s constant changes excite and worry startups, entrepreneurs, and market analysts alike. Navigating this sector without a compass can lead to pitfalls, but with the right market research, you can chart a course to success. What does technology market research entail, and how can you leverage it to innovate, differentiate, and succeed in this fast-evolving landscape?

In this comprehensive guide, we’ll explore the nuances of technology market research, offering step-by-step strategies, recommended tools, and valuable insights from a compelling case study. Buckle up as we venture into the realm of technology market analysis, a domain that demands critical thinking, foresight, and strategic decision-making.

Why Technology Market Research Demands a Different Approach

The tech industry is a dynamic beast, constantly evolving at breakneck speed. This fast-paced environment makes traditional market research methods require some fine-tuning to be truly effective. Here’s what sets tech market research apart:

Unique Considerations

Rapid Evolution: Technological advancements can disrupt entire markets seemingly overnight. Market research needs to be agile to identify these shifts and inform strategic decisions.

Shorter Product Lifecycles: Unlike other industries, tech products can become obsolete quickly. Research must capture real-time insights to predict trends and ensure products stay relevant.

Complex Buying Processes: B2B tech purchases often involve multiple stakeholders with diverse needs. Research needs to understand these complex decision-making frameworks.

Diverse Audience Segments: From Chief Technology Officers (CTOs) to partners and end-users, each segment has unique perspectives. Tailored research methods are crucial to capture their specific needs.

Main Components of Tech Market Research

Competitor Analysis: Understanding the competitive landscape is vital for differentiation and strategic planning. Research should identify key players, their strengths and weaknesses, and potential gaps in the market.

Customer Needs Assessment: Uncover the specific needs, pain points, and aspirations of your target audience. This goes beyond basic functionality to understand how technology integrates into their workflow and solves their problems.

Technology Adoption Trends: Identify emerging technologies and assess their potential impact on your product or service. Research should also explore how existing technologies are being used and evolving.

Future Forecasting: Anticipate future trends and customer needs to stay ahead of the curve. This involves analyzing macro-economic factors, technological advancements, and changing consumer behavior.

Specificities of Tech Market Research

Focus on User Experience (UX): Usability testing and user feedback are paramount in tech research. Understanding how users interact with your product is crucial for optimizing its functionality and design.

Technical Expertise: Researchers in the tech field may need some technical knowledge to understand the product or service thoroughly and effectively analyze user feedback.

Data-Driven Approach: Leverage data analytics tools to gather insights from various sources – social media sentiment analysis, website traffic patterns, competitor reviews, etc.

By understanding these unique aspects of tech market research, companies can gather valuable insights that inform successful product development, marketing strategies, and overall business growth.

Conducting Market Research in the Tech Industry: A Step-by-Step Guide

The tech industry thrives on innovation, so your market research needs to be as dynamic as the landscape itself. Here’s a step-by-step guide to help you gather valuable insights in this fast-paced environment:

Step 1: Define Your Research Objectives

Identify your target audience: Are you targeting B2B (businesses) or B2C (consumers)? Understanding who you’re researching will shape your approach.

Set clear goals: What information do you need? Is it market size, customer needs, competitor analysis, or a combination?

Step 2: Conduct Secondary Research

Industry reports: Purchase reports from reputable firms like Gartner, Forrester, or IDC to gain insights into market size, trends, and competitor analysis.

Tech publications and blogs: Stay updated on industry news and trends by following relevant publications and blogs.

Competitor websites and social media: Analyze competitor offerings, marketing strategies, and customer reviews to understand their strengths and weaknesses.

Step 3: Gather Primary Research Data

Surveys and questionnaires: Create online surveys or questionnaires to gather quantitative data from your target audience about their needs, preferences, and buying behavior.

Interviews: Conduct in-depth interviews with industry experts, potential customers, and existing users to gain qualitative insights and uncover deeper motivations.

Focus groups: Facilitate group discussions with your target audience to explore their attitudes towards technology and your specific product or service.

User testing: Observe how users interact with your product prototype to identify usability issues and areas for improvement.

Step 4: Analyze and Interpret Data

Quantitative data: Use statistical tools to analyze survey responses and identify trends and patterns.

Qualitative data: Analyze interview transcripts and focus group discussions to identify key themes and recurring issues.

Combine data sets: Integrate insights from both quantitative and qualitative research for a well-rounded understanding of your market.

Step 5: Translate Insights into Action

Identify customer needs and pain points: What problems are your customers facing that your technology can solve?

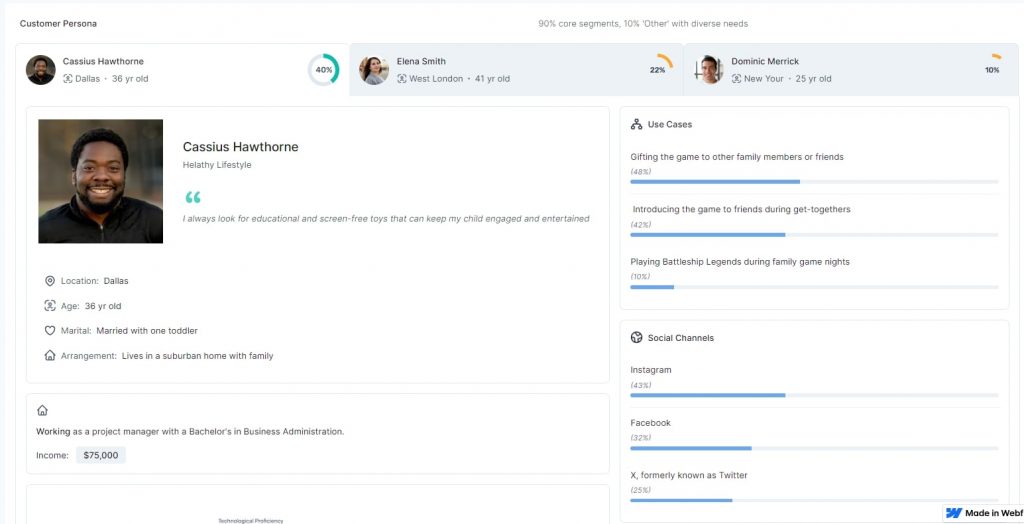

Develop buyer personas: Create detailed profiles of your ideal customers to inform product development and marketing strategies.

Refine your product or service: Use the research findings to guide product iteration and ensure it aligns with customer needs.

Develop a competitive advantage: Analyze competitor data to identify gaps in the market and differentiate your offering.

Step 6: Continuously Monitor and Adapt

Tech trends move fast: Stay updated on industry trends and emerging technologies through ongoing monitoring.

Schedule regular reviews: Revisit your research findings periodically to ensure your strategies remain aligned with the evolving market landscape.

Adapt your approach: Be prepared to adjust your research methods and focus areas as the tech industry and your target market evolve.

Tools and Resources for Technology Market Research

Conducting market research in the tech industry requires a blend of qualitative and quantitative approaches. Here’s a list of tools and resources you can use:

Market Trends and Analysis

Statista: Provides statistical data on various industries, including technology. It offers insights into market trends, consumer behavior, and industry forecasts.

Gartner: A leading research and advisory company providing insights on technology trends, market analysis, and vendor assessments. Their reports can be valuable for understanding market dynamics and emerging technologies.

Forrester: Similar to Gartner, Forrester offers research reports, analysis, and advisory services focusing on technology and its impact on businesses.

IDC (International Data Corporation): Offers market intelligence, advisory services, and events related to technology markets, including hardware, software, and services.

Consumer Behavior and Interest

Google Trends: Helps you analyze the popularity of search queries related to specific topics or keywords. It can provide insights into consumer interest and emerging trends in the tech industry.

LinkedIn: Utilize LinkedIn’s advanced search features to gather insights about your target audience, competitors, and industry influencers. Join relevant groups and participate in discussions to stay updated. (Scroll down for a full list of top groups to join.)

Reddit: Explore tech-related subreddits to gather insights, participate in discussions, and identify emerging trends. Subreddits like r/technology, r/startups, and r/programming can be particularly useful.

Quora: Search for tech-related questions and discussions on Quora to understand common pain points, industry challenges, and emerging trends. Engage with the community by asking questions or providing insights.

Startup and Innovation Discovery

Crunchbase: A platform for discovering innovative companies, startups, and key players in the tech industry. It provides information about funding rounds, acquisitions, and key personnel.

Product Hunt: A community-driven platform where users discover and share new products, including tech innovations. It can be a valuable resource for understanding emerging trends and gauging market interest.

GitHub: Explore repositories related to tech projects, libraries, and frameworks to understand developer preferences and emerging technologies. GitHub’s trending repositories and topics can provide valuable insights.

Industry News and Insights

TechCrunch: A leading technology media outlet covering news, analysis, and insights on startups, innovation, and industry trends. Regularly reading TechCrunch can help you stay informed about the latest developments in the tech sector.

LinkedIn (Groups and Discussions)

- MIT Technology Review: This group focuses on discussions around cutting-edge technology trends, research, and insights from MIT’s renowned publication.

- IEEE Technology and Engineering Management Society (TEMS): A group for professionals interested in the latest developments and management practices in technology and engineering.

- Tech Leaders Forum: A forum for technology leaders to discuss industry trends, best practices, and challenges in the tech sector.

- Artificial Intelligence & Robotics: This group focuses on discussions related to AI, machine learning, robotics, and their applications across various industries.

- IoT (Internet of Things) World: Join this group to stay updated on the latest news, trends, and discussions about the Internet of Things ecosystem.

- Cybersecurity Professionals: Discuss the latest cybersecurity threats, trends, and solutions with fellow professionals in this group.

- Big Data Analytics: Stay informed about the latest advancements, tools, and case studies in big data analytics by joining this group.

- Blockchain & Cryptocurrency: Engage in discussions about blockchain technology, cryptocurrencies, and their impact on various industries.

Reddit (Subreddits)

- r/technology | 7.8 million members | For all things technology.

- r/tech | 235,000 members | High-quality news articles about technology and informative and thought-provoking self-posts.

- r/gaming | 22.6 million members | A subreddit for (almost) anything related to games – video games, board games, card games, etc. (but not sports).

- r/techsupport | 555 thousand members | Stumped on a tech problem? Ask the tech support Reddit, and try to help others with their problems as well.

- r/buildapc | 1.5 million members | Planning on building a computer but need some advice? This is the place to ask! r/webdev | 346 thousand members | A community dedicated to all things web development: both front-end and back-end. For more design-related questions, try r/web_design.

- r/Android | 1.7 million members | Android news, reviews, tips, and discussions about rooting, tutorials, and apps.

- r/apple | 995 thousand members | An unofficial community to discuss Apple devices and software, including news, rumors, opinions, and analysis.

Customized Data Collection and Analysis

SurveyMonkey: Conduct surveys to gather feedback from your target audience, customers, or industry professionals. Surveys can help you understand market preferences, pain points, and willingness to adopt new technologies.

Prelaunch Focus Groups: Prelaunch revolutionizes market research with its accurate, rapid, flexible, and affordable approach. By requiring a deposit from participants, it ensures authentic feedback instead of incentivized responses. Brands can set up and evaluate interviews in a day or two, define their segments, and establish their questions.

Prelaunch eliminates the need for physical focus groups, costly recruitment or intricate tools, making market research simpler and comprehensive. It offers the ability for follow-up interviews and enables brands to reach global audiences instantaneously.

Competitive Analysis

Competitor Websites and Social Media: Analyze competitor websites, social media profiles, and marketing materials to gather insights about their products, strategies, and customer interactions.

Prelaunch AI Market Research Tool: This tool analyzes thousands of reviews and feedback to discover customer’s hidden needs and wants, areas for market growth, as well as track competitor strategies and results.

Industry Reports and Whitepapers

Many tech companies publish industry reports and whitepapers sharing insights, case studies, and research findings. In addition to the resources we mentioned in Market Trends and Analysis, consider these as well.

McKinsey & Company Technology Reports: McKinsey publishes reports on technology-related topics such as digital strategy, cybersecurity, and emerging technologies.

Deloitte Technology Industry Outlook: Deloitte offers an annual technology industry outlook report that provides insights into key trends, challenges, and opportunities facing the tech sector.

PwC Technology Industry Reports: PwC produces reports on technology industry trends, including topics like AI, cybersecurity, and digital innovation.

CB Insights Research: CB Insights provides research reports and market intelligence on emerging technologies, startup trends, and investment activity in the tech industry.

Accenture Technology Vision Reports: Accenture releases annual technology vision reports that highlight key trends shaping the future of technology and business.

IBM Institute for Business Value: IBM’s research institute produces reports on technology trends, industry insights, and digital transformation strategies.

Case Study: Magmo Pro

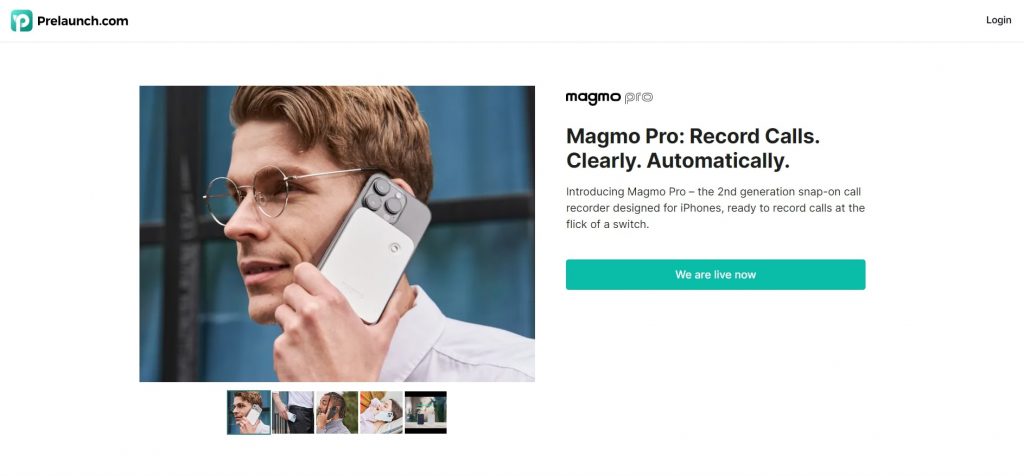

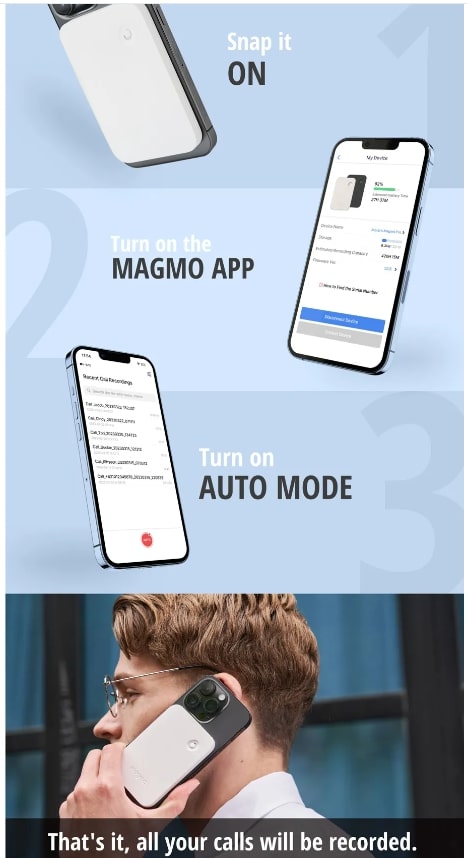

Magmo Pro is a magnetic accessory for iPhones that acts as an automatic call recorder. The product successfully underwent a Prelaunch campaign and is now moving on to its ecommerce marketing stages. It snaps onto the back of your iPhone, similar to other MagSafe accessories, and uses built-in mics to record your phone calls.

Brand: Magmo Pro

Challenges: One challenge the brand faced was a limited target audience: Magmo Pro targets a specific audience – iPhone users who need to record calls. This can make finding a large enough sample size for research challenging. Another limitation was the legal ambiguity: Call recording laws differ by location. Research is needed to consider these variations to understand user needs and concerns.

Key Insights: Market research with Prelaunch allowed Magmo Pro to identify call recording needs, frequency, and pain points with existing solutions. In this case the product was a new-and-improved iteration of their first. Thus, Magmo Pro addressed pain points such as the ability to offer better sound and longer battery life.

Results: Based on market research Magmo Pro launched with the ability to record and revisit calls. This version of Magmo included higher quality sound, longer battery life, and more convenience than before.

The product eliminates the need to deal with frustrating third-party recording apps that are either expensive, unreliable, or loaded with intrusive ads.

This case study illustrates how brands can leverage market research to gain valuable customer insights, adapt their offerings, and achieve success in the dynamic tech industry.

Overcoming Research Hurdles in the Technology Industry

Market research in the tech industry presents several challenges due to its dynamic nature and rapid pace of innovation. Here are some common challenges and strategies to mitigate them:

Rapid Technological Changes: Technologies evolve quickly, making it challenging to keep up with the latest trends and developments. Market researchers can mitigate this challenge by continuously monitoring industry news, subscribing to relevant newsletters and publications, and participating in tech-focused communities to stay updated.

Complexity of Tech Products: Tech products often have intricate features and functionalities, making it difficult to understand and analyze them thoroughly. Market researchers can address this challenge by breaking down their complex products into manageable components on a landing page which makes it easy for potential customers to engage and understand. Simplifying this process is one of the first steps in concept validation.

Data Privacy and Security Concerns: With the increasing emphasis on data privacy and security, market researchers may encounter challenges in accessing and analyzing sensitive data. To mitigate this, researchers should prioritize compliance with data protection regulations, seek explicit consent from participants when collecting data, and anonymize or aggregate data to protect individual privacy.

Limited Access to Proprietary Data: Some valuable data, such as proprietary company information or industry-specific metrics, may be inaccessible to external market researchers. To overcome this challenge, researchers can leverage publicly available data, collaborate with industry partners or associations to access relevant data sets, or use alternative research methods such as surveys and interviews to gather insights.

High Competition and Saturation: The tech industry is highly competitive, with numerous companies vying for market share in various segments. Market researchers can differentiate themselves by focusing on niche markets or emerging technologies, conducting thorough competitor analyses, and identifying unmet needs or underserved customer segments.

Bias in Data Analysis: Unconscious biases can influence data collection, analysis, and interpretation, leading to skewed results and flawed insights. To mitigate bias, market researchers should employ diverse research methods, use multiple sources of data for validation, involve stakeholders from different backgrounds in the research process, and remain vigilant in challenging assumptions and preconceptions.

Balancing Quantitative and Qualitative Insights: Finding the right balance between quantitative data (e.g., statistics, metrics) and qualitative insights (e.g., customer feedback, user experiences) can be challenging in tech market research. Researchers can address this by integrating both quantitative and qualitative approaches, triangulating data from multiple sources, and using mixed-methods research designs to gain a comprehensive understanding of the market.

That said, this process is very labor-intensive so one solution would be to use platforms like Prelaunch.com that already does the leg work for you. When you create a landing page for your product on Prelaunch, all data is collected in a single Dashboard. This means you don’t have to cross quantitative and qualitative insights manually. Rather it’s done for you.

From a demographic and psychographic breakdown of your audience to showing you the responses from surveys and focus groups, Prelaunch helps you gather all the information to make the most informed decisions.

By acknowledging and actively addressing these challenges, market researchers and creators in the tech industry can enhance the quality and reliability of their research findings, ultimately leading to more informed decision-making and strategic planning.

Conclusion

Conducting market research in the rapidly evolving tech industry requires awareness and adaptation to its unique challenges. By utilizing a diverse array of resources like industry news platforms, social media analysis, and advanced analytical tools, researchers can stay ahead of technological advancements and understand complex market dynamics.

Overcoming obstacles such as rapid technological changes, data privacy concerns, and the competition-laden landscape is critical for obtaining actionable insights. Employing strategies to counteract these challenges—like engaging with tech communities, leveraging both quantitative and qualitative data, and maintaining vigilance against biases—enables researchers to capture the nuanced reality of the tech market. Ultimately, the key to successful market research in this sector lies in continuous learning, adaptability, and a comprehensive approach to gathering and analyzing data.

FAQ

What is technology market research?

Technology market research is the systematic process of gathering, analyzing, and interpreting data related to the technology sector. It involves studying market trends, consumer behaviors, emerging technologies, competitors, and other factors that impact the technology industry.

The goal is to provide valuable insights and intelligence to tech businesses. This intelligence helps them make strategic decisions about product development, marketing strategies, and overall business growth in a dynamic environment.

Who should be conducting technology market research?

Tech market research can be conducted by internal teams within a company or by external market research agencies specializing in the technology sector.

Internal Teams:

- Product managers, marketing teams, and business development teams can benefit from conducting internal research to understand their target audience and competitive landscape.

- However, internal teams may lack the objectivity or resources for in-depth research.

Market Research Agencies:

- External agencies often have extensive experience in the tech industry and access to specialized research tools and methodologies.

- They can provide an objective perspective and ensure the research is conducted rigorously.

- Hiring an agency can be a good option for companies needing in-depth research or lacking the internal resources.

What types of market research are most appropriate for the technology industry?

The most appropriate research methods for the tech industry depend on the specific research objectives. However, some methods are particularly well-suited for the fast-paced and dynamic nature of the tech sector:

Online Surveys and Questionnaires: Efficiently gather quantitative data from a large pool of potential customers or industry professionals.

In-depth Interviews: Gain qualitative insights and uncover user motivations and pain points through detailed conversations.

Social Listening & Online Community Analysis: Track online conversations, identify emerging trends, and understand customer sentiment through social media platforms and online forums.

Usability Testing: Observe how users interact with prototypes or existing products to identify usability issues and improve the user experience.

Competitive Analysis: Analyze competitor websites, marketing strategies, and user reviews to understand their strengths, weaknesses, and market positioning.

Tech market research is most effective when it utilizes a combination of these methods to get a well-rounded view of the market landscape.