In the competitive landscape of business-to-business (B2B) markets, understanding your audience is paramount. Whether you’re a business owner looking to expand your market reach, a marketing professional aiming to refine your strategies, or a business student eager to learn the ropes, mastering B2B market research is essential. This comprehensive guide covers the benefits, methods, and real-world examples of effective B2B market research.

What is B2B Market Research?

B2B market research is the systematic process of gathering information about businesses that are potential customers. This information can include their needs, wants, and buying behaviors. By conducting B2B market research, companies can gain valuable insights that can help them to:

- Develop new products and services

- Improve their marketing and sales strategies

- Understand their competition

- Make better business decisions

There are two main types of B2B market research: Primary and secondary research. Primary research involves collecting data directly from potential customers, such as through surveys, interviews, or focus groups. Meanwhile, secondary research involves collecting data that has already been collected by someone else, such as industry reports, government data, or competitor analysis.

Explore our comprehensive article for a detailed guide on different types of market research.

B2B market research is an essential tool for any company that wants to succeed in the business-to-business market. By understanding their target audience, companies can develop products and services that meet their needs and create marketing campaigns that resonate with them. So, let’s dive in.

B2B vs. B2C: Key Differences

The main difference between B2B (business-to-business) and B2C (business-to-consumer) markets boils down to who the customer is that in B2B transactions, the customer is another business. This means the products or services sold are used for further business operations, not by individual consumers. For instance, a company that sells office supplies to other businesses is operating in B2B.

By comparison, B2C businesses sell directly to individual consumers. The products or services are intended for personal use. Examples of B2C companies include clothing stores, grocery stores, and streaming services.

Here’s a breakdown of some key differences that stem from this core distinction:

Customers: B2B buyers are typically more rational and focus on features, functionality, and return on investment (ROI). B2C customers might be swayed by emotions, branding, and aesthetics.

Sales Cycles: B2B sales cycles are often longer and involve multiple decision-makers within the customer company. B2C sales cycles are usually shorter and involve a single consumer making the purchase decision.

Marketing: B2B marketing strategies target specific industries and businesses. B2C marketing appeals to a broader audience and uses a more emotional approach.

Products: B2B products are often complex and require a trained user. B2C products are designed for easy use by the general public.

Pricing: B2B pricing can be complex and involve negotiation. B2C pricing is typically more straightforward with set prices.

Understanding these differences is crucial for businesses to develop effective marketing, sales, and product development strategies.

Benefits of B2B Market Research

Market research serves as a compass for businesses, guiding them towards a deeper understanding of their target market, competitors, and the overall market dynamics. This understanding translates into a plethora of benefits, ultimately leading to better decision-making and increased chances of success. Here’s a closer look at some key benefits of market research, along with illustrative examples:

Customer-Centric Approach

Market research allows businesses to gather data on demographics, preferences, and buying behaviors of their target audience. This can be achieved through surveys, interviews, focus groups, or social media listening. For instance, a company considering launching a new plant-based meat substitute might conduct surveys to gauge customer interest in such a product, preferred flavor profiles, and price sensitivity. This information helps them tailor the product development process and marketing strategy to resonate with their target vegetarian and vegan customer base.

Improved Communication and Customer Satisfaction

By understanding customer needs and pain points through market research, businesses can craft communication that addresses their concerns and expectations. Imagine a clothing retailer using focus groups to understand why customers abandon online shopping carts. The research might reveal sizing inconsistencies or a confusing checkout process. With this knowledge, the retailer can improve their website navigation, size charts, and offer live chat support to enhance customer experience and satisfaction.

Effective Product Development and Pricing Strategies

Market research helps identify customer needs and gaps in the market. This valuable input can inform the development of new products or features that cater directly to unmet customer needs. Additionally, research on competitor pricing strategies and customer price sensitivity allows businesses to set competitive and profitable pricing for their offerings. For example, a company developing a fitness tracker might use market research to learn about existing features in competitor products, desired functionalities from potential customers, and their willingness to pay for certain features. This data guides them in creating a feature-rich tracker at a price point that aligns with customer expectations.

Identifying and Capitalizing on Market Opportunities

Market research isn’t just about identifying problems; it’s also about uncovering opportunities. Through research, businesses can discover emerging trends, changing consumer preferences, and potential new markets. For instance, a research report might indicate a growing demand for sustainable home cleaning products. A cleaning product manufacturer can leverage this insight to develop a new eco-friendly product line, potentially capturing a new market segment.

Reduced Risk and Informed Decision-Making

Launching a new product or entering a new market can be fraught with risk. Market research helps mitigate these risks by providing insights into potential challenges and opportunities. Imagine a company contemplating expanding its operations to a new country. Market research would provide valuable data on the target market size, competitor landscape, regulations, and consumer preferences in that specific country. This information allows the company to make informed decisions about the feasibility and potential success of their expansion plans.

How to Conduct B2B Market Research

Effective B2B market research equips you with the knowledge to navigate the specific landscape of business-to-business interactions. Here’s a roadmap to guide you through the process:

Step 1: Define Your Research Goals and Objectives

What are you trying to achieve? Clearly outline what information you need and how it will be used. Are you looking to: Identify customer pain points and unmet needs? Evaluate competitor strengths and weaknesses. Gauge market potential for a new product or service? Understand industry trends and buying behaviors?

Step 2: Understand Your Target Audience

Who are you trying to reach? In B2B, your target audience goes beyond demographics; it focuses on specific company sizes, industries, and decision-making roles within those organizations (e.g., CFOs, procurement managers).

Tip: Leverage industry reports and publications to gain insights into your target audience’s needs and challenges. Consider conducting pilot interviews with a few potential customers to gain a preliminary understanding.

Step 3: Choose Your Research Methods

There are two main approaches to gather data, and you can often use a combination of both for a well-rounded picture:

Primary Research: Collect first-hand information directly from your target audience.

Surveys: Cost-effective way to gather data from a large sample size. Use tools like SurveyMonkey or Google Forms to create and distribute online surveys.

Interviews: In-depth interviews with key decision-makers provide rich qualitative data. Use online meeting platforms like Zoom or conduct phone interviews.

Focus Groups: Gather a small group for a moderated discussion to uncover deeper insights and customer sentiment.

Prelaunch.com: The concept validation platform brings together surveys, interviews, and focus groups through a landing page that lets you present your product to the world and use analytics to track how they engage, what price point they’re willing to pay, and what version of your product they’d most like to see.

Secondary Research: Utilize existing data from credible sources.

Industry Reports: Market research firms publish reports on industry trends, competitor analysis, and market sizing. Look for reputable firms like Gartner or Forrester.

Government Data: Government agencies provide valuable data on economic indicators, demographics, and industry trends. Explore resources from the US Bureau of Labor Statistics or your local government’s statistical office.

News Articles & Social Media Listening: Stay updated on industry news and social media conversations to understand customer sentiment. Use social listening tools like Brandwatch or Sprout Social.

AI Market Research Assistant: This tool lets you analyze thousands of reviews/feedback and look at the top customer praises and complaints of competitor products on Amazon.com.

Step 4: Data Collection and Analysis

Gather information based on your chosen methods. Ensure your surveys are well-designed with clear and concise questions. Prepare interview guides for focused discussions.

Organize your data. Use spreadsheets for basic data or consider data analysis software like SPSS or SAS for complex datasets.

Analyze your data: For quantitative data (surveys), use statistical methods to identify patterns and trends. For qualitative data (interviews, focus groups), use thematic coding to categorize recurring themes and insights.

Step 5: Reporting and Recommendations

Present your findings in a clear and concise format. Create reports with visuals like charts and graphs to effectively communicate insights.

Translate your findings into actionable recommendations. How can different business functions (marketing, sales, product development) leverage these insights to achieve your research objectives?

Example: Your research might reveal that marketing automation is a major pain point for manufacturing marketing managers, but current solutions are complex and expensive. Your recommendation could be to develop a user-friendly and affordable marketing automation tool specifically designed for this audience.

Step 6: Take Action and Monitor Results

Implement your recommendations. Based on your research, develop and execute marketing campaigns, refine product features, or adjust your sales strategy.

Monitor the results. Track key metrics to measure the impact of your actions based on the research insights.

By following these steps and continuously refining your research approach, you can ensure B2B market research becomes a strategic tool for your business, guiding you towards informed decisions and sustainable growth.

Case Studies and Examples

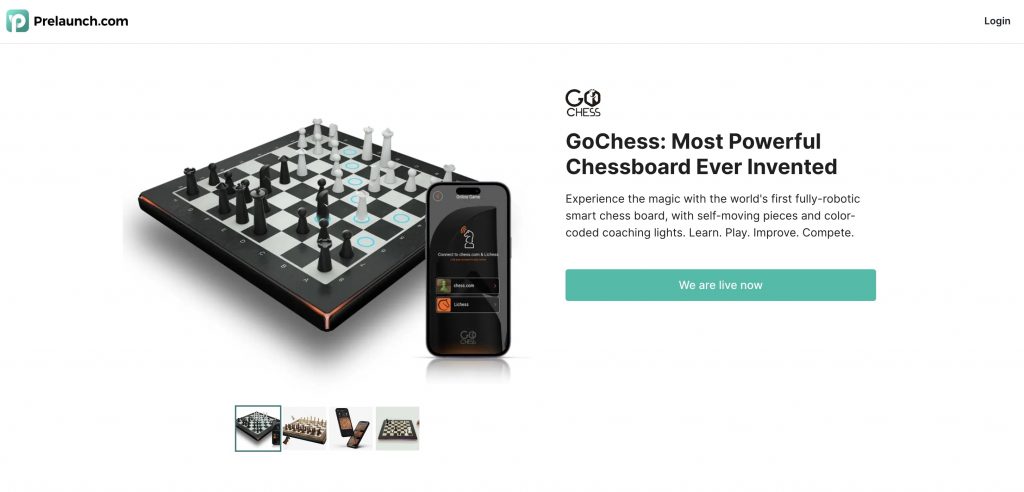

This case encapsulates the strategy and success of GoChess, an innovative product from Particula, becoming Kickstarter’s most-funded chess campaign. Particula used Prelaunch.com to validate their product’s market aptitude and price point. GoChess was designed to bridge the gap between traditional and digital gaming, providing an interactive, AI-powered gaming experience for chess enthusiasts worldwide.

Prelaunch.com kicked off the GoChess journey by helping identify and understand the product’s potential market. They deployed a highly targeted campaign during the prelaunch stage, focusing on four key realms: product benefits, positioning, target audience, and price. A captivating landing page was created to feature core product offerings, establishing trust in the brand.

Running targeted Facebook and Instagram ads helped identify the key demographics interested in GoChess, notably from the UK, USA, Germany, Italy, and The Netherlands. The data collected from this campaign was critical for future marketing strategies.

A vital aspect of Prelaunch.com’s strategy was the determination of the product’s optimal price. Through iterative testing, they gauged the responses from potential backers regarding different GoChess pricing options. Originally set at $449, they eventually established the main board, GoChess 4XR, should have an average campaign price of $359, balancing profitability and affordability.

The iterative process of pricing validation helped refine the pricing strategy, build trust among potential backers, and mitigate any risk, indicating strong market acceptance for GoChess. This careful approach to pricing was crucial for GoChess’s successful launch. The case indicates that the Prelaunch.com platform can significantly enhance B2B market research, preparing products for a successful market entry.

Conclusion

B2B market research is an invaluable tool for business owners, marketing professionals, and students alike. By understanding the unique dynamics of B2B markets, you can make informed decisions, identify new opportunities, and gain a competitive edge. The key is to approach research systematically, leveraging both qualitative and quantitative methods to gather comprehensive insights.

Ready to take your B2B strategy to the next level? Start by investing in thorough market research, and let the data guide your path to success.