The pet industry has burgeoned into a vast and vibrant market, teeming with opportunities but also challenges that can stump even the most seasoned professionals. Understanding these intricacies through market research is not just beneficial; it’s essential for anyone looking to make their mark.

This guide will traverse the realm of pet industry market research, offering insights, and actionable strategies, and illuminating a real-world success story that showcases what’s possible with the right approach.

What Makes Market Research for the Pet Industry Unique?

The pet industry is a booming business, but it also has its own quirks when it comes to market research. Here’s what sets it apart:

Pet as Family: People see their pets as family members, not just animals. This emotional connection translates to a willingness to spend more on premium products, experiences, and healthcare. Understanding this emotional bond is crucial.

Multiple Decision-Makers: Often, pets don’t buy their own food or toys! You need to consider both the pet’s needs and the pet owner’s preferences when researching the market.

Trendy & Niche Markets: The pet industry is full of fads and niche markets. From raw food diets to CBD treats, there’s a constant stream of new products and services. Your research needs to be nimble to keep up.

Influence of Social Media: Pet owners are highly active on social media, sharing photos and experiences. This creates a strong sense of community and can be a goldmine for research on pet owner preferences and concerns.

Here’s how to approach market research with these unique factors in mind:

Target the Right Audience: Don’t just focus on general pet owners. Segment your audience by pet type (dog, cat, exotic), income level, or lifestyle (active, health-conscious).

Consider Both Pets and Owners: Research the needs of the pet itself, but also delve into owner demographics, purchasing habits, and emotional drivers.

Go Beyond Surveys: Combine traditional surveys with qualitative research methods like focus groups and social media listening to understand the deeper motivations behind purchases. (There are a few tricks to this tip. More on that in the sections below.)

Look for Niche Opportunities: The pet industry is full of potential for niche products and services. Use your research to identify gaps in the market.

Stay on Top of Trends: The pet industry is constantly evolving. To stay ahead of the curve, regularly monitor social media, industry publications, and pet influencer channels.

How to Do Pet Industry Market Research [Step-by-Step Guide]

The pet industry thrives on innovation, but to ensure your product stands out, thorough market research is crucial. Here’s a breakdown of the process, keeping in mind the unique aspects of the pet market:

Step 1: Define Your Goals & Target Audience

What are you aiming to achieve? Is it understanding interest in a new food type, identifying a gap in the dog toy market, or gauging customer response to a subscription service? Having a clear goal in mind is key to getting your research process started on the right foot.

Who is your ideal customer? Young urban professionals with small dogs? Busy families with large breeds? Demographics, lifestyle, and pet type all influence buying decisions.

Step 2: Gather Secondary Research

Leverage existing data from industry reports (e.g., American Pet Products Association) and market research firms to understand overall pet industry trends, market size, and growth projections.

Look for pet industry publications and online resources to get a sense of current popular products and services (e.g. Pets+ Magazine, Pet Food Industry, Pet Business World)

Step 3: Conduct Primary Research

Quantitative Research (Surveys & Polls): Craft surveys or polls targeted to your ideal customer. Use online survey tools like Google Forms or SurveyMonkey to gather data on demographics, pet ownership habits, purchasing preferences, and price sensitivity.

For example, say you are developing a new type of eco-friendly cat litter. Your survey might ask cat owners about their current litter preferences, concerns about sustainability, and willingness to pay a premium for an eco-friendly option.

Qualitative Research (Focus Groups & Social Listening): Go deeper by conducting focus groups with pet owners to understand their emotional connection to their pets, pain points with existing products and unmet needs.

Social media listening tools can also be valuable. Track conversations about pet products on platforms like Instagram and Twitter to identify trends, concerns, and popular brands.

Continuing the example above, focus groups for your eco-friendly litter could reveal concerns about odor control or tracking. Social listening might show pet owners complaining about the mess traditional clay litter creates.

Pro tip: To expedite your time and efforts, consider using market research platforms like Prelaunch.com, which use cross-qualitative and quantitative methods. Prelaunch lets you quickly build an idea-validating campaign that gives you insights from embedded surveys. Meanwhile, the platform’s AI Market Research Feature serves as a great tool for social listening, summarizing thousands of reviews and feedback to uncover the top customer praises and complaints.

Step 4: Analyze & Interpret Results

Analyze your survey data to identify trends and patterns. Use focus group discussions and social media insights to understand the “why” behind the data.

Pro tip: Sometimes finding the “why” may not be so easy. That’s why Prelaunch helps you analyze and interpret your data by segmenting out the “reasons for interest” as well as noting any objections potential customers had when they interacted with your product virtually on the prelaunch landing page.

Step 5: Actionable Insights & Recommendations

Based on your research, refine your product concept or service offering to better meet the needs and desires of your target market. Identify potential marketing strategies and messaging that resonate with your target audience.

Pro tip: This step is also made easy on Prelaunch. Once you’ve made alterations to your product (even if it’s just visual), fine-tuned your message, and formulated all the advantages it has to offer, you can make those tweaks and re-run your concept validation campaign on Prelaunch to confirm you’re on the right track.

By following these steps and keeping the unique aspects of the pet industry in mind, you can conduct market research that provides valuable insights to guide your pet product’s success.

Tools and Resources for Pet Industry Market Research

Here are some tools and resources you can use to conduct market research for the pet industry:

Secondary Research

Industry reports and data

- American Pet Products Association (APPA): The website publishes industry reports and market size data to help businesses understand the pet industry landscape.

- Euromonitor International: This provides market research reports on a variety of industries, including the pet industry. Their reports include data on market size, trends, and consumer behavior.

Pet industry publications

- Pets+ Magazine: An all-encompassing resource with news, trade shows, product information, and industry trends.

- Pet Food Industry: A trusted source for pet retailers and service providers, covering product trends, marketing strategies, and industry regulations.

- Pet Business World: This global publication offers news on pet products, retailing, and pet care across various animal categories.

Primary Research

- Surveys and polls: You can use online survey tools like Google Forms or SurveyMonkey to gather data from pet owners about their demographics, pet ownership habits, purchasing preferences, and price sensitivity.

- Focus groups: Conducting focus groups with pet owners can help you understand their emotional connection to their pets, pain points with existing products, and unmet needs.

- Social media listening: Social media listening tools can help you track conversations about pet products on platforms like Instagram and Twitter to identify trends, concerns, and popular brands. Some popular social media listening tools include Brandwatch, Sprout Social, and Hootsuite.

- Prelaunch.com: This market research suite lets you do several things from a single platform. Use Prelaunch to create a landing page for your next pet product and see what potential customers value, what they would like to see more of and what concerns and needs they have. You’ll also be able to test for optimal price and learn what positioning would best present your product.

Other Resources

Trade shows and conferences: Attending pet industry trade shows and conferences can help you learn about new products and trends, and network with other industry professionals.

- Global Pet Expo: This is one of the largest pet industry trade shows held annually in Orlando, Florida. It features exhibitors showcasing the latest pet products, educational seminars, and networking events.

- SuperZoo: Another major pet industry trade show, SuperZoo takes place in Las Vegas, Nevada. It offers a wide range of products and services for pet retailers, groomers, and service providers.

- Petfood Forum: This conference focuses specifically on the pet food sector, covering topics such as nutrition, ingredients, manufacturing, and market trends. It is usually held in various locations across the United States.

- Pet Retail World: Formerly known as Total Pet Expo, this trade show targets independent pet retailers and features exhibitors offering products ranging from pet food to accessories.

- Pet Expo Thailand: This event takes place in Bangkok and is one of the largest pet industry exhibitions in Southeast Asia. It showcases a variety of pet products, services, and innovations.

- Pet Connections Expo: Held in the United States, this trade show caters to pet retailers, distributors, and manufacturers, offering networking opportunities and educational sessions.

- Interzoo: While primarily focused on the international pet supplies market, Interzoo in Germany is one of the largest trade shows for the pet industry worldwide. It covers a wide range of products and services for pets, including food, accessories, and healthcare products.

By using a variety of tools and resources, you can gather the information you need to conduct thorough market research for the pet industry.

Case Study: PooPail’s Pre-Launch Triumph – A Stellar Example of Market Research Done Right

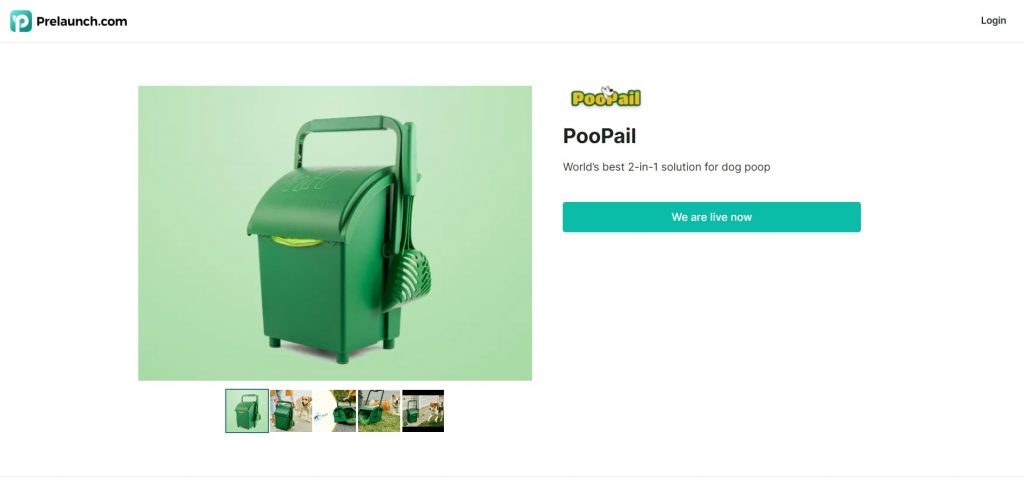

PooPail, a dual-purpose system for dog waste removal and storage, raised nearly $500K on Kickstarter, supported by market validating and product fitting process on Prelaunch.com. CEO Sandy Stinson invented PooPail as a solution to managing her dogs’ waste in her large backyard. Her idea provided an efficient and odorless way to deal with dog poop, but initial launch results were underwhelming.

Sandy recognized the need to test market response and pricing strategy before another launch and sought Prelaunch’s help. Prelaunch tested various headlines and key messages, with the most successful one emphasizing PooPail’s unique dual-function feature.

Market and price validation were achieved through a series of tests. Pricing strategies ranging from $79 to $39 were evaluated. While the highest price saw lower purchase intent, interest in the product remained consistent. Lowering the price incrementally saw an increase in purchase interest and subscription rate. After all testing, the optimal launch price for the PooPail was set at $44.

Prelaunch.com also tested various advertisements, focusing primarily on the most engaged demographic of females aged 25-54 in Australia, the US, Canada, and Great Britain. The most effective visuals and texts were identified and used to optimize ads.

Thanks to Prelaunch.com’s extensive product-market testing, Sandy’s second launch of PooPail was a resounding success, generating $463,831 with the support of 5,322 backers, representing a 40 times increase over the initial launch.

Overcoming Market Research Challenges in the Pet Industry

The pet industry, with its fervent pace of innovation and deeply personal customer base, poses unique challenges:

Reaching the Decision Maker: While pets are the beneficiaries, pet owners hold the purse strings. Crafting surveys or recruiting focus groups needs to consider the human making the buying decisions. (So, for instance, when crafting a landing page that effectively presents the benefits of your product make sure to list points that make the pet owner’s life easier.)

Emotional Biases: Pet owners have a strong emotional connection to their pets. Survey questions or focus group discussions might be influenced by this love, leading to skewed results on things like pricing or preference.

Rapidly Evolving Trends: New fads and niche markets emerge quickly in the pet industry. Your research needs to be adaptable to capture these shifts in consumer interests. (This is why the ability to tweak and rerun your prelaunch campaign is extremely important. Better to rerun a virtual campaign than to spend thousands in redoing a product you’ve already produced.)

Accuracy of Pet Information: Sometimes, pet owners might be unsure of their pet’s breed or exact food consumption, impacting the accuracy of data collected on pet needs.

Fragmented Media Landscape: Pet owners get their information from a variety of sources, from social media influencers to veterinary clinics. Capturing a comprehensive view of their information consumption can be difficult.

By being aware of these challenges, you can design your research methods to mitigate them and get the most accurate data possible to guide your pet product development.

Takeaway Doggie Bag

Pet industry market research is an indispensable tool for navigating this emotionally charged, fast-evolving market. By understanding the unique characteristics of pet industry consumers and leveraging strategic research methodologies, businesses can uncover valuable insights that drive success.

FAQ

What is pet industry market research?

Pet industry market research is the process of gathering information about the pet product and service market. This information can be used to understand consumer needs and preferences, identify trends, and assess the potential success of a new product or service.

Who should be conducting pet industry market research?

Anyone who wants to develop, market, or sell pet products or services can benefit from conducting market research. This includes:

- Entrepreneurs with new pet product ideas

- Established pet product companies looking to expand their offerings

- Marketing and advertising agencies working with pet industry clients

- Retailers who want to stock the right products for their customers

What types of market research are most appropriate for the pet industry?

There are two main types of market research: secondary research and primary research. Both can be valuable for the pet industry, depending on your specific needs.

Secondary research involves using existing data and information that has already been collected by others. This can include industry reports, government data, and articles from pet industry publications. Secondary research is a good way to get a quick overview of the market and identify potential trends.

Primary research involves collecting your own data through surveys, focus groups, or social media listening. This type of research can be more time-consuming and expensive than secondary research, but it can provide you with more in-depth information about your target market.